Edge AI Software Market Summary

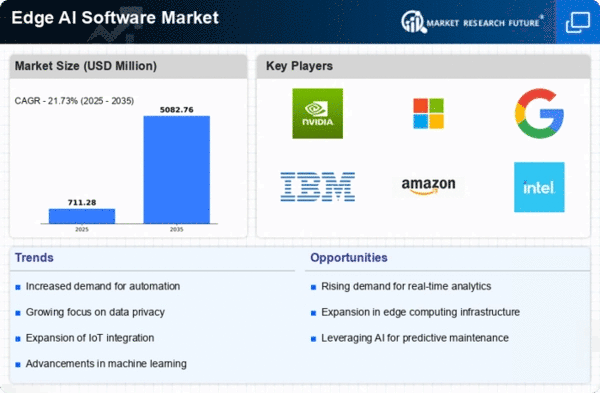

As per MRFR analysis, the Edge AI Software Market Size was estimated at 584.31 USD Million in 2024. The Edge AI Software industry is projected to grow from 711.3 in 2025 to 5082.76 by 2035, exhibiting a compound annual growth rate (CAGR) of 21.73% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Edge AI Software Market is experiencing robust growth driven by technological advancements and increasing demand for real-time data processing.

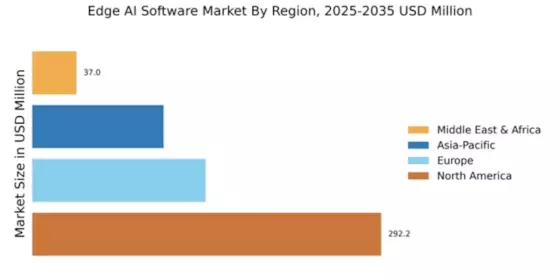

- North America remains the largest market for Edge AI Software, driven by significant investments in IoT and AI technologies.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid digital transformation and increased adoption of smart devices.

- Predictive Maintenance continues to dominate the market, while Real-Time Data Processing is witnessing the fastest growth due to its critical role in operational efficiency.

- Key market drivers include the rising demand for real-time data processing and advancements in machine learning algorithms, particularly in the healthcare and manufacturing sectors.

Market Size & Forecast

| 2024 Market Size | 584.31 (USD Million) |

| 2035 Market Size | 5082.76 (USD Million) |

| CAGR (2025 - 2035) | 21.73% |

Major Players

NVIDIA (US), Microsoft (US), Google (US), IBM (US), Amazon (US), Intel (US), Qualcomm (US), Edge Impulse (US), Siemens (DE), C3.ai (US)