Influence of Social Media

Social media platforms play a pivotal role in shaping perceptions of beauty and influencing decisions related to cosmetic surgery. In Japan, platforms such as Instagram and TikTok have become essential tools for sharing before-and-after images, testimonials, and experiences related to cosmetic procedures. This visibility has led to a surge in interest, particularly among younger demographics. The cosmetic surgery market is experiencing a notable increase in inquiries and consultations, with reports suggesting a 25% rise in online searches for cosmetic procedures in the past year. As influencers and celebrities openly discuss their experiences, the cosmetic surgery market continues to benefit from heightened awareness and acceptance.

Economic Factors and Affordability

Economic conditions significantly influence the cosmetic surgery market in Japan. With a stable economy and rising disposable incomes, more individuals are willing to invest in cosmetic procedures. The average cost of popular surgeries, such as rhinoplasty and breast augmentation, ranges from ¥300,000 to ¥1,000,000, making them accessible to a broader audience. Additionally, financing options and payment plans offered by clinics further enhance affordability. As economic stability continues, the cosmetic surgery market is likely to see sustained growth, with an estimated increase of 20% in the number of procedures performed over the next five years. This trend suggests that financial considerations are becoming less of a barrier to entry for potential patients.

Advancements in Surgical Techniques

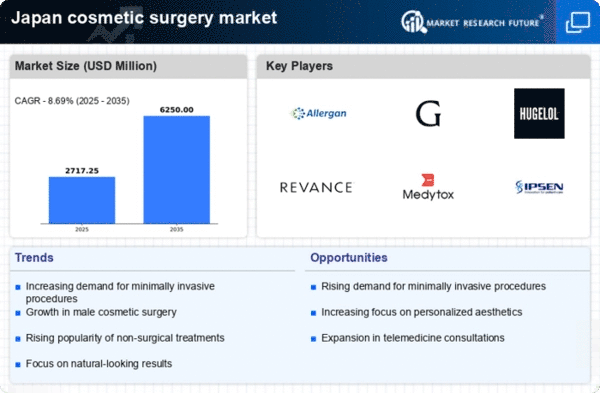

Innovations in surgical techniques and technologies are transforming the landscape of the cosmetic surgery market. Minimally invasive procedures, such as endoscopic surgery and laser treatments, are gaining popularity due to their reduced recovery times and lower risks. Clinics in Japan are increasingly adopting these advanced methods, which not only enhance patient safety but also improve overall outcomes. The introduction of new technologies, such as 3D imaging and virtual consultations, is further streamlining the process for patients. As these advancements continue to evolve, the cosmetic surgery market is expected to expand, with a projected growth rate of 10% annually as patients seek the latest and most effective options for aesthetic enhancement.

Growing Acceptance of Cosmetic Procedures

The increasing acceptance of cosmetic procedures among the Japanese population is a notable driver in the cosmetic surgery market. Cultural shifts have led to a more open attitude towards aesthetic enhancements, with surveys indicating that approximately 30% of individuals aged 18-34 express interest in undergoing cosmetic surgery. This trend is particularly pronounced among women, who account for a significant portion of the market. The cosmetic surgery market in Japan is projected to reach ¥500 billion by 2026, reflecting a growing willingness to invest in personal appearance. As societal norms evolve, the stigma surrounding cosmetic surgery diminishes, encouraging more individuals to consider these procedures as a viable option for self-improvement.

Aging Population and Demand for Rejuvenation

Japan's aging population is a significant driver of the cosmetic surgery market, as more individuals seek procedures to maintain a youthful appearance. With over 28% of the population aged 65 and older, there is a growing demand for surgical and non-surgical options that address age-related concerns. Procedures such as facelifts, eyelid surgery, and dermal fillers are increasingly popular among older adults. The cosmetic surgery market is projected to grow by 15% annually, driven by this demographic shift. As the population ages, the desire for rejuvenation and enhanced self-esteem propels the market forward, indicating a sustained interest in cosmetic enhancements.