Emergence of AI-Driven Automation

The emergence of AI-driven automation is significantly influencing the contact center-as-a-service market in Japan. Businesses are increasingly adopting AI technologies to streamline operations, reduce costs, and enhance service efficiency. AI-powered chatbots and virtual assistants are being integrated into contact center solutions, enabling organizations to handle high volumes of customer inquiries with minimal human intervention. This trend is expected to lead to a reduction in operational costs by up to 30% while improving response times. As companies seek to optimize their customer service processes, The contact center-as-a-service market is likely to expand. This expansion is driven by the growing reliance on AI for automation and efficiency.

Integration of Advanced Analytics

The integration of advanced analytics into the contact center-as-a-service market is becoming increasingly vital for organizations in Japan. Businesses are leveraging data analytics to gain insights into customer behavior, preferences, and trends. This capability allows for more personalized customer interactions and improved service delivery. According to recent studies, companies utilizing analytics in their contact centers have reported a 20% increase in customer satisfaction rates. As organizations strive to enhance their customer experience, the demand for analytics-driven solutions within the contact center-as-a-service market is expected to rise, enabling businesses to make data-informed decisions and optimize their operations.

Regulatory Compliance and Data Privacy

In Japan, regulatory compliance and data privacy concerns are driving the evolution of the contact center-as-a-service market. With stringent regulations such as the Act on the Protection of Personal Information (APPI), businesses are compelled to adopt solutions that ensure data security and compliance. This has led to an increased focus on selecting service providers that prioritize data protection measures. The contact center-as-a-service market is likely to experience growth. This growth is due to organizations seeking to mitigate risks associated with data breaches and non-compliance. As a result, service providers that offer robust security features and compliance support are becoming increasingly attractive to businesses operating in this regulatory landscape.

Growing Demand for Remote Work Solutions

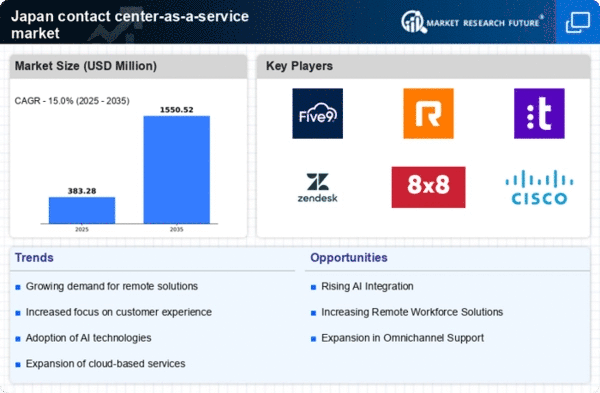

The increasing trend towards remote work in Japan has led to a heightened demand for flexible and scalable solutions in the contact center-as-a-service market. Organizations are seeking to maintain operational efficiency while allowing employees to work from various locations. This shift is reflected in the market, which is projected to grow at a CAGR of approximately 15% over the next five years. Companies are investing in cloud-based contact center solutions that facilitate seamless communication and collaboration among remote teams. As businesses adapt to this new normal, The contact center-as-a-service market is likely to see a surge in adoption. This surge is driven by the need for effective customer engagement and support in a remote work environment.

Shift Towards Customer-Centric Strategies

The shift towards customer-centric strategies is reshaping the contact center-as-a-service market in Japan. Organizations are recognizing the importance of delivering exceptional customer experiences to foster loyalty and retention. This trend is prompting businesses to invest in solutions that enable personalized interactions and proactive customer support. The contact center-as-a-service market is witnessing a transformation. Companies are adopting technologies that facilitate omnichannel communication and real-time feedback. As customer expectations continue to evolve, the demand for innovative solutions that enhance customer engagement is likely to drive growth in the market, positioning customer experience as a key differentiator in competitive landscapes.