Contact Center as a Service Market Summary

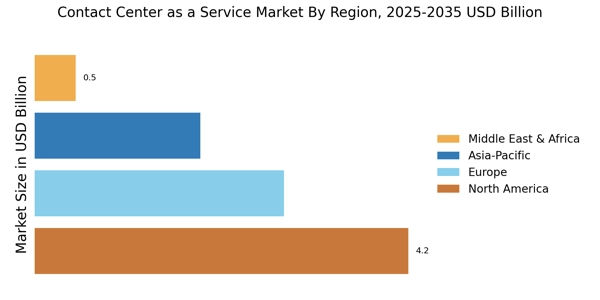

As per Market Research Future analysis, the Contact Center as a Service Market Size was estimated at 9.257 USD Billion in 2024. The Contact Center as a Service industry is projected to grow from 10.65 USD Billion in 2025 to 43.07 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 15.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Contact Center as a Service Market is experiencing robust growth driven by technological advancements and evolving customer expectations.

- The market is witnessing increased adoption of AI technologies, enhancing operational efficiency and customer interactions.

- Omnichannel communication is becoming a focal point, allowing businesses to engage customers seamlessly across various platforms.

- Data security and compliance are gaining prominence, particularly in North America, as organizations prioritize safeguarding customer information.

- The rising demand for remote work solutions and the integration of advanced analytics are key drivers propelling growth in both the Automatic Call Distribution and Small and Medium-Sized Enterprises segments.

Market Size & Forecast

| 2024 Market Size | 9.257 (USD Billion) |

| 2035 Market Size | 43.07 (USD Billion) |

| CAGR (2025 - 2035) | 15.0% |

Major Players

Five9 (US), RingCentral (US), Twilio (US), Genesys (US), NICE (IL), Talkdesk (US), 8x8 (US), Cisco (US), Verint (US)