Government Initiatives and Support

Government initiatives play a crucial role in shaping the cloud engineering market in Japan. The Japanese government has been actively promoting digital transformation across various industries, recognizing the importance of cloud technologies in enhancing competitiveness. Initiatives such as the 'Digital Agency' aim to streamline cloud adoption and encourage public sector organizations to migrate to cloud-based solutions. Furthermore, the government has allocated substantial funding to support research and development in cloud technologies, which is expected to bolster the cloud engineering market. As a result, businesses are likely to benefit from increased access to resources and expertise, fostering innovation and growth within the sector. This supportive environment may lead to a projected increase in cloud adoption rates, potentially reaching 70% among enterprises by 2025.

Rising Demand for Scalable Solutions

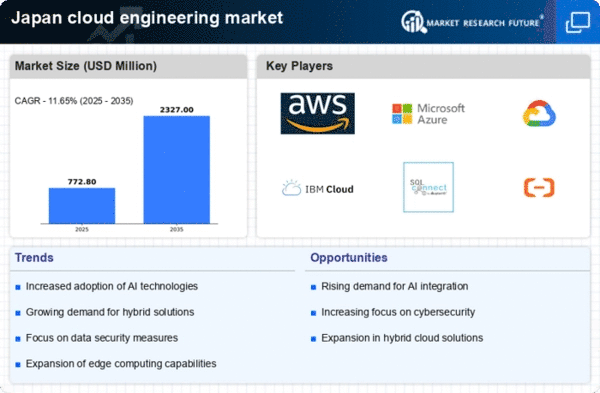

The cloud engineering market in Japan experiences a notable surge in demand for scalable solutions. As businesses increasingly seek to enhance operational efficiency, the ability to scale resources dynamically becomes paramount. This trend is particularly evident in sectors such as finance and retail, where fluctuating workloads necessitate flexible cloud architectures. According to recent data, the market for cloud services in Japan is projected to reach approximately $20 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 15%. This growth is driven by the need for organizations to adapt to changing market conditions while maintaining cost-effectiveness. Consequently, cloud engineering market providers are focusing on developing innovative solutions that facilitate seamless scalability, thereby positioning themselves to meet the evolving needs of Japanese enterprises.

Shift Towards Sustainable Cloud Practices

The cloud engineering market in Japan is experiencing a shift towards sustainable cloud practices. As environmental concerns gain prominence, businesses are increasingly seeking cloud solutions that align with sustainability goals. This trend is reflected in the growing demand for energy-efficient data centers and eco-friendly cloud services. Companies are recognizing that adopting sustainable practices not only enhances their corporate social responsibility but also leads to cost savings in the long run. Recent reports suggest that organizations that prioritize sustainability in their cloud strategies can reduce operational costs by up to 30%. This shift is prompting cloud engineering market providers to innovate and develop solutions that minimize environmental impact, thereby appealing to a broader range of customers who value sustainability.

Increased Emphasis on Disaster Recovery Solutions

The cloud engineering market in Japan is witnessing an increased emphasis on disaster recovery solutions. As businesses become more aware of the potential risks associated with data loss and system failures, the demand for robust disaster recovery strategies is on the rise. Cloud-based disaster recovery solutions offer organizations the ability to quickly restore operations in the event of an outage, ensuring business continuity. Recent surveys indicate that approximately 60% of Japanese companies prioritize disaster recovery planning as part of their cloud strategy. This growing awareness is prompting cloud engineering market providers to enhance their offerings, focusing on solutions that ensure data integrity and minimize downtime. Consequently, organizations are likely to invest more in cloud services that provide comprehensive disaster recovery capabilities, further driving market growth.

Growing Focus on Artificial Intelligence Integration

The integration of artificial intelligence (AI) into cloud engineering market solutions is gaining traction in Japan. Organizations are increasingly recognizing the potential of AI to enhance operational efficiency and drive innovation. By leveraging AI capabilities, businesses can optimize resource allocation, improve decision-making processes, and automate routine tasks. This trend is particularly relevant in sectors such as manufacturing and healthcare, where data-driven insights can lead to significant improvements in productivity. As a result, cloud engineering market providers are investing in AI-driven solutions to meet the rising demand. Recent estimates suggest that the AI market in Japan could reach $10 billion by 2025, further fueling the growth of cloud services that incorporate AI technologies. This convergence of AI and cloud engineering is likely to reshape the competitive landscape, offering new opportunities for businesses to differentiate themselves.