Increased Focus on Data Analytics

In the current landscape, organizations in India are placing a heightened emphasis on data analytics to drive decision-making and strategic initiatives. The cloud engineering market is benefiting from this trend as businesses seek to harness the power of big data and analytics tools hosted on cloud platforms. With an estimated 80% of organizations planning to invest in data analytics solutions by 2025, the demand for cloud engineering services is expected to rise. This focus on data-driven insights is likely to propel the development of advanced cloud solutions tailored to meet the analytical needs of various industries.

Government Initiatives and Policies

The Indian government is actively promoting the adoption of cloud technologies through various initiatives and policies aimed at enhancing the digital economy. Programs such as Digital India and Make in India are designed to encourage businesses to leverage cloud solutions for improved service delivery and operational efficiency. The government has allocated substantial funding to support cloud infrastructure development, which is expected to bolster the cloud engineering market. With an estimated growth rate of 25% annually, the market is likely to see increased participation from both public and private sectors, fostering innovation and collaboration in cloud engineering.

Growing E-commerce and Online Services

The rapid expansion of e-commerce and online services in India is significantly impacting the cloud engineering market. As consumer behavior shifts towards digital platforms, businesses are compelled to adopt cloud solutions to manage increased traffic and data. The e-commerce sector alone is projected to reach $200 billion by 2026, necessitating robust cloud infrastructure to support scalability and reliability. This trend is prompting companies to invest in cloud engineering services to enhance their digital capabilities, thereby driving growth in the market. The demand for seamless online experiences is likely to further accelerate the adoption of cloud technologies.

Rising Demand for Digital Transformation

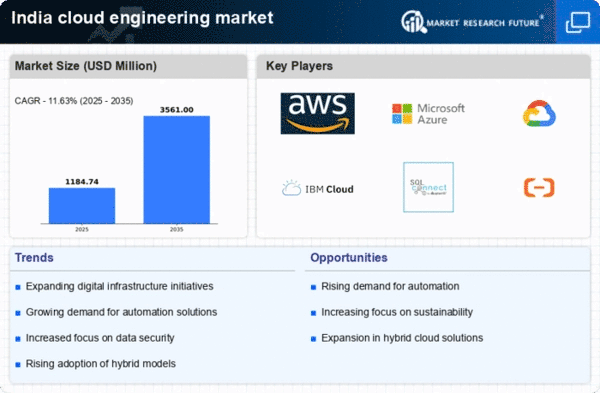

The cloud engineering market in India is experiencing a notable surge in demand driven by the ongoing digital transformation across various sectors. Organizations are increasingly adopting cloud solutions to enhance operational efficiency and agility. According to recent data, approximately 70% of Indian enterprises are expected to migrate to cloud platforms by 2025. This shift is largely influenced by the need for scalable infrastructure and the ability to leverage advanced technologies. As businesses seek to innovate and remain competitive, the cloud engineering market is positioned to benefit significantly from this trend, as companies invest in cloud-native applications and services to streamline their operations.

Emergence of Startups and Innovation Hubs

The startup ecosystem in India is thriving, with numerous innovation hubs emerging across the country. This growth is fostering a vibrant environment for the cloud engineering market, as startups increasingly rely on cloud solutions to build and scale their businesses. With over 50,000 startups currently operating in India, many are leveraging cloud technologies to minimize infrastructure costs and enhance their agility. The cloud engineering market is likely to see a surge in demand for tailored solutions that cater to the unique needs of these startups, driving innovation and competition within the sector.