Shift to Remote Work Models

The transition to remote work in Japan has significantly influenced the cloud access-security-broker market. As organizations embrace flexible work arrangements, the reliance on cloud services has surged. This shift necessitates enhanced security measures to ensure that remote employees can access corporate resources securely. In 2025, it is projected that over 30% of the workforce in Japan will continue to work remotely, creating a sustained demand for cloud access-security-broker solutions. Companies are increasingly recognizing the importance of securing remote access to sensitive information, which is likely to drive investments in cloud security technologies. This trend underscores the need for comprehensive security strategies that encompass both on-premises and cloud environments.

Rising Cybersecurity Threats

The cloud access-security-broker market in Japan is experiencing growth due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to adopt advanced security measures to protect sensitive data stored in the cloud. In 2025, it is estimated that cybercrime could cost the Japanese economy over $1 trillion, prompting businesses to invest in cloud access security solutions. This trend indicates a heightened awareness of the need for robust security frameworks, which is driving demand for cloud access-security-broker services. As companies seek to mitigate risks associated with data breaches, the market is likely to expand, with a focus on innovative security technologies that can adapt to evolving threats.

Increased Focus on Data Privacy

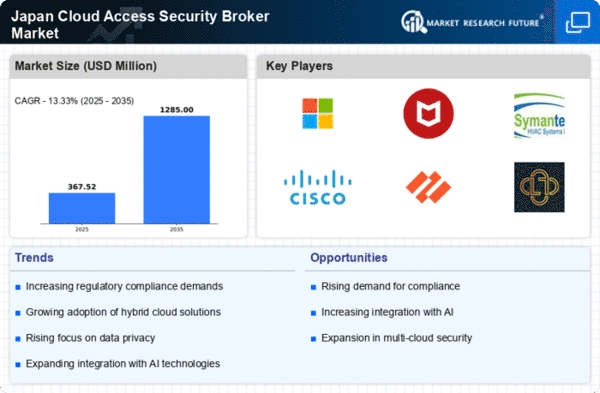

Data privacy concerns are becoming increasingly prominent in Japan, influencing the cloud access-security-broker market. With the implementation of stricter data protection regulations, businesses are under pressure to safeguard personal information. The cloud access-security-broker market is likely to benefit from this trend as organizations seek solutions that ensure compliance with privacy laws. In 2025, it is anticipated that 70% of Japanese companies will prioritize data privacy in their cloud strategies, driving demand for security solutions that can effectively manage and protect sensitive data. This focus on privacy not only enhances consumer trust but also positions cloud access-security-broker services as essential components of modern business operations.

Growing Adoption of Cloud Services

The rapid adoption of cloud services in Japan is a key driver for the cloud access-security-broker market. As businesses migrate their operations to the cloud, the need for effective security solutions becomes paramount. In 2025, the cloud services market in Japan is expected to reach approximately $20 billion, highlighting the increasing reliance on cloud infrastructure. This growth presents opportunities for cloud access-security-broker providers to offer tailored solutions that address specific security challenges associated with cloud environments. Organizations are seeking to ensure compliance with data protection regulations while leveraging the benefits of cloud technology, thereby fueling demand for security brokers that can facilitate secure cloud access.

Emergence of Advanced Security Technologies

The emergence of advanced security technologies is reshaping the cloud access-security-broker market in Japan. Innovations such as artificial intelligence, machine learning, and behavioral analytics are being integrated into security solutions to enhance threat detection and response capabilities. As organizations seek to stay ahead of cyber threats, the adoption of these technologies is likely to accelerate. In 2025, it is projected that the market for AI-driven security solutions will grow by 25%, indicating a strong demand for cloud access-security-broker services that leverage cutting-edge technologies. This trend suggests that businesses are increasingly recognizing the value of proactive security measures, which could lead to a more competitive landscape in the cloud access-security-broker market.