Rising Cybersecurity Threats

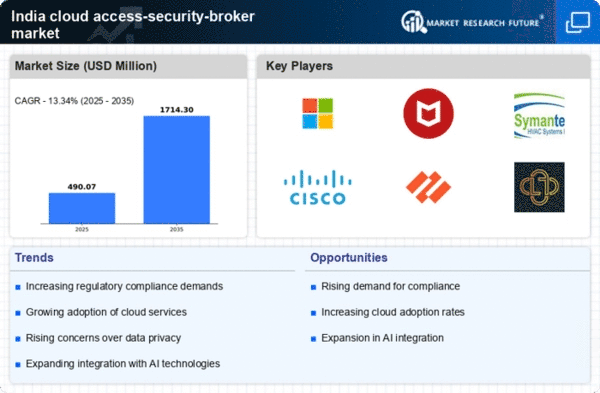

The growth of the cloud access-security-broker market is due to the increasing frequency and sophistication of cyber threats in India. Organizations are becoming more aware of the vulnerabilities associated with cloud services, prompting them to seek robust security solutions. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, with a significant portion of this impact felt in India. As a result, companies are investing in cloud access-security-broker solutions to safeguard sensitive data and ensure compliance with regulatory requirements. This heightened focus on cybersecurity is driving demand for advanced security measures, thereby propelling the growth of the cloud access-security-broker market.

Growing Awareness of Data Privacy

The rising awareness of data privacy among consumers and businesses in India is significantly impacting the cloud access-security-broker market. As individuals become more conscious of their data rights, organizations are compelled to implement stringent security measures to protect personal information. This shift in consumer expectations is driving businesses to invest in cloud access-security-broker solutions that enhance data protection and privacy compliance. In 2025, it is projected that the data privacy market in India could reach $3 billion, indicating a strong correlation between consumer awareness and the demand for security solutions. This trend underscores the importance of cloud access-security-broker services in addressing privacy concerns.

Digital Transformation Initiatives

Digital transformation is reshaping the business landscape in India, driving organizations to adopt innovative technologies and cloud solutions. This transformation often involves the integration of various applications and services, which can create security vulnerabilities. Consequently, There is increased demand for cloud access-security-broker solutions as businesses seek to secure their digital assets. In 2025, it is estimated that investments in digital transformation initiatives could exceed $20 billion in India, highlighting the critical role of cloud access-security-broker solutions in ensuring secure and seamless digital operations. This trend suggests that as organizations embrace digital change, the need for robust security measures will intensify.

Regulatory Compliance Requirements

The stringent regulatory landscape in India significantly influences the cloud access-security-broker market. With the introduction of laws such as the Personal Data Protection Bill, organizations are compelled to adopt comprehensive security measures to protect personal data. Compliance with these regulations is not only a legal obligation but also a critical factor in maintaining customer trust. As businesses strive to meet these requirements, the demand for cloud access-security-broker solutions is expected to rise. In 2025, it is projected that compliance-related investments in India could reach $5 billion, further underscoring the importance of security brokers in navigating the complex regulatory environment.

Increased Adoption of Cloud Services

The rapid adoption of cloud services across various sectors in India is a key driver for the cloud access-security-broker market. As organizations migrate to the cloud for enhanced flexibility and scalability, they face new security challenges that necessitate the implementation of access security measures. In 2025, the cloud services market in India is anticipated to grow by over 30%, leading to a corresponding increase in the need for cloud access-security-broker solutions. This trend indicates that as more businesses transition to cloud environments, the demand for effective security solutions will continue to escalate, thereby fostering growth in the cloud access-security-broker market.