Increased Focus on Sustainability

Sustainability has emerged as a critical driver in the Japan Building Automation System Market. With growing awareness of environmental issues, both consumers and businesses are prioritizing sustainable practices. Building automation systems contribute to sustainability by optimizing energy use, reducing waste, and enhancing indoor air quality. The Japanese government has set ambitious targets for carbon neutrality by 2050, which necessitates the widespread adoption of energy-efficient technologies. This focus on sustainability not only aligns with The Building Automation System for substantial growth as stakeholders seek to implement eco-friendly solutions in their buildings.

Rising Demand for Smart Buildings

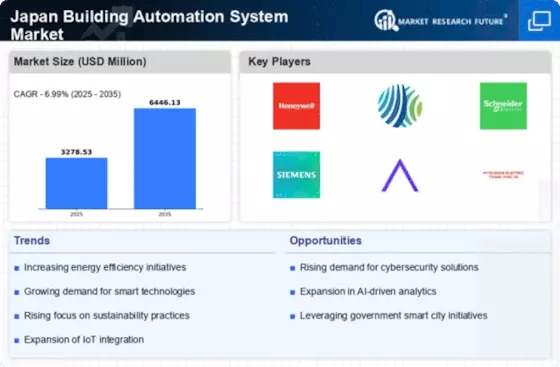

The Japan Building Automation System Market is witnessing a surge in demand for smart buildings, driven by urbanization and changing consumer preferences. As cities become more densely populated, the need for efficient building management systems has become paramount. Smart buildings equipped with advanced automation technologies enhance operational efficiency, reduce energy consumption, and improve occupant comfort. According to recent estimates, the smart building market in Japan is projected to grow at a compound annual growth rate of over 10% through 2026. This trend indicates a robust appetite for building automation solutions that integrate seamlessly with existing infrastructure, thereby propelling the growth of the Japan Building Automation System Market.

Government Initiatives and Regulations

The Japan Building Automation System Market is significantly influenced by government initiatives aimed at promoting energy efficiency and sustainability. The Japanese government has implemented various regulations that encourage the adoption of building automation systems, particularly in commercial and residential sectors. For instance, the Energy Conservation Act mandates energy-saving measures in buildings, which has led to an increased demand for automation solutions. Furthermore, the government's commitment to reducing greenhouse gas emissions by 26% by 2030 has spurred investments in smart building technologies. This regulatory environment not only fosters innovation but also creates a favorable market landscape for building automation systems, as stakeholders seek to comply with these stringent standards.

Integration of Renewable Energy Sources

The integration of renewable energy sources is becoming increasingly relevant in the Japan Building Automation System Market. As Japan aims to diversify its energy mix and reduce reliance on fossil fuels, building automation systems that facilitate the use of solar, wind, and other renewable energy sources are gaining traction. These systems enable buildings to optimize energy consumption and manage energy storage effectively. For example, smart grids and energy management systems allow for real-time adjustments based on energy availability and demand. This trend not only supports Japan's energy goals but also enhances the appeal of building automation solutions, as they contribute to a more sustainable and resilient energy future.

Technological Advancements in Automation

Technological advancements play a pivotal role in shaping the Japan Building Automation System Market. Innovations in artificial intelligence, machine learning, and the Internet of Things (IoT) are revolutionizing how buildings are managed and operated. These technologies enable real-time monitoring and control of building systems, leading to enhanced efficiency and reduced operational costs. For instance, the integration of IoT devices allows for predictive maintenance, which minimizes downtime and extends the lifespan of equipment. As these technologies continue to evolve, they are likely to drive further adoption of building automation systems in Japan, creating a more interconnected and efficient built environment.