Integration of Smart Technologies

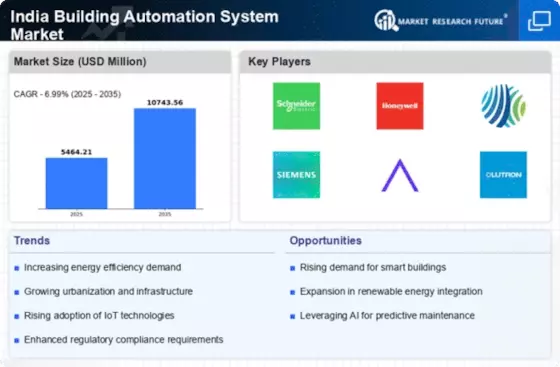

The integration of smart technologies in the India Building Automation System Market is a pivotal driver. The proliferation of Internet of Things (IoT) devices facilitates real-time monitoring and control of building systems, enhancing operational efficiency. As of January 2026, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 15%, driven by the increasing adoption of smart sensors and automation solutions. This trend is further supported by the rising demand for smart homes and commercial buildings, where automation systems optimize energy consumption and improve occupant comfort. The convergence of artificial intelligence and machine learning with building automation systems is likely to revolutionize the industry, enabling predictive maintenance and advanced analytics. Consequently, the integration of these technologies is expected to play a crucial role in shaping the future landscape of the India Building Automation System Market.

Government Initiatives and Policies

Government initiatives and policies significantly influence the India Building Automation System Market. The Indian government has implemented various policies aimed at promoting energy efficiency and sustainability in buildings. For instance, the Energy Conservation Building Code (ECBC) encourages the adoption of building automation systems to reduce energy consumption. As of January 2026, the government is likely to continue its support through incentives and subsidies for energy-efficient technologies, which could further stimulate market growth. Additionally, the Smart Cities Mission aims to develop urban areas with advanced infrastructure, including automated building systems. This initiative is expected to create substantial opportunities for market players, as cities increasingly invest in smart technologies to enhance urban living. Thus, government support is a critical driver for the expansion of the India Building Automation System Market.

Rising Demand for Energy Efficiency

The rising demand for energy efficiency is a fundamental driver in the India Building Automation System Market. With increasing energy costs and environmental concerns, both residential and commercial sectors are seeking solutions to optimize energy usage. As of January 2026, the market is witnessing a shift towards energy-efficient building designs, where automation systems play a vital role in monitoring and controlling energy consumption. Reports indicate that buildings equipped with automation systems can achieve energy savings of up to 30%. This trend is further bolstered by the growing awareness of sustainability among consumers and businesses alike. Consequently, the demand for building automation systems that enhance energy efficiency is expected to surge, positioning this driver as a key factor in the market's growth trajectory.

Increased Focus on Safety and Security

Increased focus on safety and security is emerging as a crucial driver in the India Building Automation System Market. With the rise in urban crime rates and safety concerns, building owners are increasingly investing in automation systems that enhance security measures. As of January 2026, the market is witnessing a growing demand for integrated security solutions, including surveillance systems, access control, and fire alarm systems, all of which can be managed through centralized building automation platforms. This trend is likely to be further amplified by the increasing awareness of the importance of safety in residential and commercial spaces. Consequently, the emphasis on safety and security is expected to drive the adoption of building automation systems, positioning this driver as a key factor in the market's ongoing evolution.

Urbanization and Infrastructure Development

Urbanization and infrastructure development are significant drivers of the India Building Automation System Market. As urban populations continue to grow, there is an increasing need for efficient building management solutions. The rapid expansion of cities in India necessitates the construction of smart buildings equipped with advanced automation systems. As of January 2026, the urbanization rate in India is projected to reach approximately 35%, leading to a surge in demand for building automation technologies. This trend is further supported by government initiatives aimed at developing smart cities, which prioritize the integration of automation systems in new constructions. The focus on modernizing infrastructure is likely to create substantial opportunities for market players, as stakeholders seek to implement innovative solutions that enhance operational efficiency and sustainability in urban environments.