Rising Incidence of Breast Cancer

The increasing incidence of breast cancer in Japan is a primary driver for the breast imaging market. According to recent statistics, breast cancer cases have been on the rise, with estimates suggesting that approximately 1 in 8 women may develop the disease during their lifetime. This alarming trend has led to heightened awareness and the necessity for early detection, thereby propelling the demand for advanced imaging technologies. The breast imaging market is expected to grow as healthcare providers emphasize the importance of regular screenings and diagnostic imaging. Furthermore, the Japanese government has initiated various campaigns to promote breast cancer awareness, which could potentially increase the number of women seeking imaging services. As a result, the breast imaging market is likely to experience significant growth in response to these rising incidence rates.

Government Initiatives and Funding

Government initiatives aimed at improving breast cancer detection and treatment are significantly influencing the breast imaging market. In Japan, the Ministry of Health, Labour and Welfare has implemented various programs to enhance screening rates and access to imaging technologies. These initiatives often include funding for advanced imaging equipment and training for healthcare professionals. For instance, the government has allocated substantial budgets to support breast cancer screening programs, which may lead to an increase in the adoption of mammography and other imaging modalities. This financial backing not only aids in the procurement of state-of-the-art imaging devices but also encourages healthcare facilities to expand their services. Consequently, the breast imaging market is likely to benefit from these supportive government measures, fostering an environment conducive to growth and innovation.

Technological Innovations in Imaging

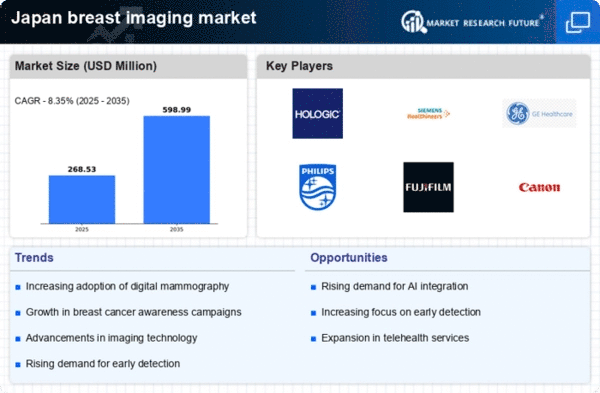

Technological innovations in imaging modalities are transforming the breast imaging market in Japan. The introduction of advanced technologies such as digital mammography, 3D tomosynthesis, and MRI has enhanced the accuracy and efficiency of breast cancer detection. These innovations allow for better visualization of breast tissue, leading to improved diagnostic outcomes. As healthcare providers increasingly adopt these cutting-edge technologies, the breast imaging market is expected to expand. Moreover, the integration of artificial intelligence in imaging analysis is emerging as a game-changer, potentially increasing the speed and accuracy of diagnoses. The continuous evolution of imaging technologies suggests that the breast imaging market will remain dynamic, with ongoing advancements likely to drive further growth in the coming years.

Aging Population and Healthcare Demand

Japan's aging population is a significant factor driving the breast imaging market. As the demographic landscape shifts, the proportion of older women, who are at a higher risk for breast cancer, continues to increase. This demographic change is likely to lead to a greater demand for breast imaging services, as older women are encouraged to undergo regular screenings. The breast imaging market may experience growth as healthcare systems adapt to accommodate the needs of this aging population. Additionally, the increasing prevalence of chronic diseases among older adults may further necessitate comprehensive imaging services. As a result, the breast imaging market is expected to expand in response to the healthcare demands of an aging society, highlighting the need for accessible and effective imaging solutions.

Growing Awareness of Preventive Healthcare

The growing awareness of preventive healthcare among the Japanese population is a crucial driver for the breast imaging market. As more individuals recognize the importance of early detection in improving treatment outcomes, there is a noticeable increase in the number of women participating in regular screenings. Educational campaigns and community outreach programs have played a vital role in promoting the benefits of breast imaging. This shift towards preventive healthcare is likely to result in a higher demand for imaging services, as women become more proactive about their health. Consequently, the breast imaging market is poised for growth, as healthcare providers adapt to meet the rising needs of a more health-conscious population. This trend may also encourage further investments in imaging technologies and facilities.