Growing Aging Population

The growing aging population in South Korea is a significant driver for the breast imaging market. As the population ages, the risk of breast cancer increases, necessitating more frequent screenings and diagnostic imaging. With approximately 15% of the population aged 65 and older, there is a heightened demand for breast imaging services tailored to older women. This demographic shift is prompting healthcare providers to enhance their imaging capabilities to accommodate the needs of an aging population. Additionally, older women are more likely to participate in regular screening programs, further driving the demand for breast imaging technologies. The breast imaging market is expected to expand as healthcare systems adapt to the changing demographics and prioritize the health of older women.

Rising Incidence of Breast Cancer

The increasing incidence of breast cancer in South Korea is a primary driver for the breast imaging market. According to recent statistics, breast cancer has become the most prevalent cancer among women in the country, with an estimated incidence rate of 50.2 per 100,000 women. This alarming trend necessitates enhanced screening and diagnostic measures, thereby propelling the demand for advanced imaging technologies. The breast imaging market is expected to expand as healthcare providers prioritize early detection and intervention strategies. Furthermore, the South Korean government has implemented various initiatives aimed at improving cancer screening rates, which further stimulates market growth. As awareness of breast cancer rises, the need for effective imaging solutions becomes increasingly critical, indicating a robust future for the breast imaging market in South Korea.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in shaping the breast imaging market in South Korea. The Ministry of Health and Welfare has launched several programs aimed at increasing access to breast cancer screening and diagnostic services. These initiatives often include subsidized screening programs for women, particularly those in high-risk categories. As a result, the breast imaging market is likely to experience growth driven by increased funding for healthcare facilities to acquire advanced imaging technologies. Additionally, public health campaigns aimed at educating women about the importance of regular screenings contribute to a more informed population, which may lead to higher participation rates in screening programs. The financial support from the government not only enhances the availability of imaging services but also encourages technological advancements within the breast imaging market.

Increased Private Sector Investment

Increased private sector investment is emerging as a vital driver for the breast imaging market in South Korea. Private healthcare providers are increasingly recognizing the importance of advanced imaging technologies in improving patient care and outcomes. This trend is leading to significant investments in state-of-the-art imaging equipment and facilities. As private hospitals and clinics enhance their imaging capabilities, they are likely to attract more patients seeking high-quality breast cancer screening and diagnostic services. Moreover, competition among private providers may lead to innovations and improvements in service delivery, further stimulating the breast imaging market. The influx of private capital into the healthcare sector is expected to foster a more dynamic and responsive breast imaging market, ultimately benefiting patients through improved access and quality of care.

Technological Innovations in Imaging

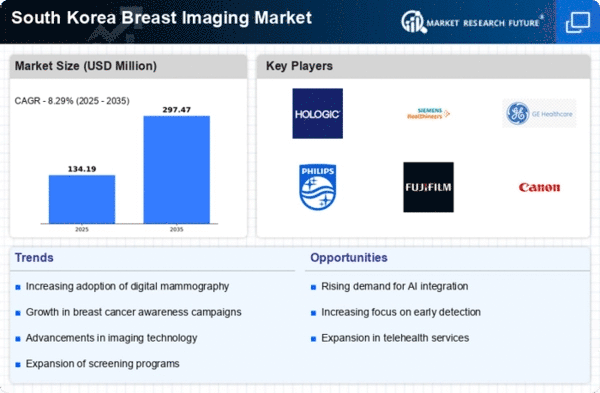

Technological innovations are significantly influencing the breast imaging market in South Korea. The introduction of advanced imaging modalities, such as digital mammography, 3D tomosynthesis, and MRI, has revolutionized breast cancer detection and diagnosis. These technologies offer improved accuracy and reduced false-positive rates, which are critical for patient outcomes. The market is witnessing a shift towards more sophisticated imaging solutions that provide better visualization of breast tissue. Furthermore, the integration of artificial intelligence in imaging analysis is expected to enhance diagnostic capabilities, making the breast imaging market more efficient. As healthcare providers increasingly adopt these innovations, the demand for state-of-the-art imaging equipment is likely to rise, indicating a positive trajectory for the market in the coming years.