Increased Adoption of Mobile Devices

The Japan A2P messaging market is benefiting from the increased adoption of mobile devices among consumers. As smartphone penetration in Japan reached over 90% in 2025, businesses are recognizing the importance of mobile-first communication strategies. A2P messaging serves as a vital tool for reaching customers directly on their mobile devices, facilitating timely and relevant interactions. This trend suggests that companies are likely to invest in mobile-optimized messaging solutions to enhance their outreach efforts. Furthermore, the rise of mobile applications is expected to complement A2P messaging, as businesses leverage app notifications to engage users effectively. The convergence of mobile technology and A2P messaging is likely to create new opportunities for brands to connect with their audience in a more meaningful way.

Growing Demand for Customer Engagement

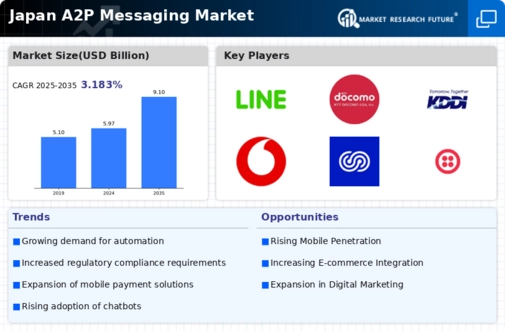

The Japan A2P messaging market is experiencing a notable surge in demand for customer engagement solutions. Businesses are increasingly recognizing the importance of direct communication with their customers. This trend is evidenced by a reported increase in A2P messaging traffic, which reached approximately 30 billion messages in 2025. Companies are leveraging A2P messaging to enhance customer experience through personalized notifications, promotional offers, and service updates. This growing demand is likely to drive innovation in messaging platforms, as organizations seek to optimize their communication strategies. Furthermore, the integration of customer feedback mechanisms within A2P messaging is expected to foster deeper relationships between brands and consumers, thereby solidifying the industry's growth trajectory.

Expansion of E-commerce and Digital Services

The Japan A2P messaging market is significantly influenced by the rapid expansion of e-commerce and digital services. As online shopping continues to gain traction, businesses are increasingly utilizing A2P messaging to facilitate order confirmations, shipping notifications, and customer support. In 2025, the e-commerce sector in Japan was valued at over 20 trillion yen, highlighting the potential for A2P messaging to enhance operational efficiency and customer satisfaction. This trend suggests that companies are likely to invest in robust messaging solutions to streamline their communication processes. Additionally, the rise of mobile payment systems and digital wallets is expected to further propel the demand for A2P messaging, as businesses seek to provide timely updates and transaction alerts to their customers.

Regulatory Framework and Compliance Requirements

The Japan A2P messaging market is shaped by a stringent regulatory framework that governs data privacy and communication practices. The Personal Information Protection Act (PIPA) mandates that businesses adhere to strict guidelines when handling customer data. Compliance with these regulations is crucial for companies operating in the A2P messaging space, as non-compliance can result in significant penalties. In 2025, it was reported that approximately 70% of businesses in Japan prioritized compliance in their messaging strategies. This focus on regulatory adherence is likely to drive investment in secure messaging solutions that ensure data protection and foster consumer trust. As the regulatory landscape continues to evolve, businesses may need to adapt their A2P messaging practices to remain compliant and competitive.

Technological Advancements in Messaging Solutions

The Japan A2P messaging market is poised for growth due to ongoing technological advancements in messaging solutions. Innovations such as artificial intelligence and machine learning are being integrated into A2P messaging platforms, enabling businesses to automate responses and personalize interactions. In 2025, it was estimated that over 40% of A2P messages utilized AI-driven technologies to enhance user engagement. This shift towards smarter messaging solutions indicates a potential for increased efficiency and effectiveness in customer communication. Moreover, the adoption of rich communication services (RCS) is likely to transform the landscape of A2P messaging, offering businesses enhanced capabilities to deliver multimedia content and interactive experiences to their customers.