Increasing Cancer Incidence

The rising incidence of cancer in Italy is a crucial driver for the tissue microarray market. As cancer cases continue to escalate, the demand for advanced diagnostic tools, including tissue microarrays, is likely to increase. According to recent statistics, cancer is projected to affect approximately 1 in 3 individuals in Italy, necessitating innovative solutions for early detection and treatment. Tissue microarrays facilitate high-throughput analysis of tumor samples, enabling researchers and clinicians to identify biomarkers and tailor therapies. This growing need for personalized treatment options is expected to propel the tissue microarray market forward, as healthcare providers seek efficient methods to improve patient outcomes.

Government Funding for Research

Government initiatives in Italy aimed at enhancing cancer research and diagnostics are significantly influencing the tissue microarray market. Increased funding for biomedical research, particularly in oncology, has led to the establishment of numerous research centers and collaborations. For instance, the Italian government has allocated substantial resources to support innovative research projects, which often incorporate tissue microarray technology. This financial backing not only fosters advancements in cancer research but also encourages the adoption of tissue microarrays in clinical settings. As a result, the tissue microarray market is likely to experience growth driven by enhanced research capabilities and improved diagnostic accuracy.

Rising Demand for Biomarker Discovery

The increasing focus on biomarker discovery in Italy is driving the tissue microarray market. As researchers seek to identify novel biomarkers for various diseases, including cancer, the utility of tissue microarrays becomes apparent. These platforms enable high-throughput screening of tissue samples, facilitating the identification of potential biomarkers that can lead to breakthroughs in diagnostics and therapeutics. The Italian research community is actively engaged in biomarker studies, supported by both public and private funding. This growing emphasis on biomarker research is expected to propel the tissue microarray market, as the need for efficient and reliable tools for biomarker discovery continues to rise.

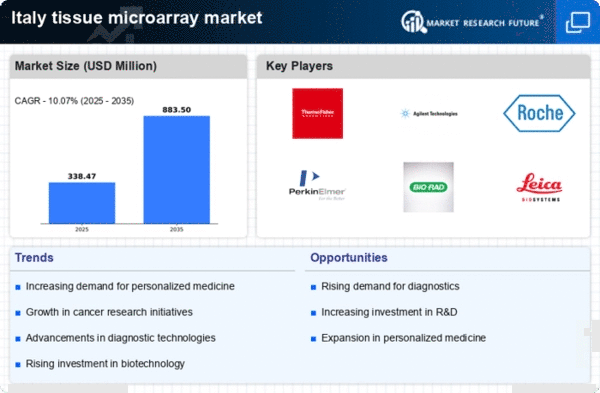

Advancements in Diagnostic Technologies

Technological advancements in diagnostic tools are significantly impacting the tissue microarray market in Italy. Innovations in imaging techniques, data analysis, and automation are enhancing the capabilities of tissue microarrays, making them more efficient and user-friendly. For example, the integration of artificial intelligence in image analysis allows for more accurate interpretation of results, thereby improving diagnostic outcomes. As healthcare providers increasingly adopt these advanced technologies, the tissue microarray market is likely to expand. The continuous evolution of diagnostic methodologies suggests a robust future for tissue microarrays, as they become integral to modern pathology and oncology.

Growing Awareness of Precision Medicine

The rising awareness of precision medicine among healthcare professionals and patients in Italy is a notable driver for the tissue microarray market. As the healthcare landscape shifts towards personalized treatment approaches, the demand for technologies that support this paradigm is increasing. Tissue microarrays play a pivotal role in identifying specific biomarkers that guide treatment decisions, thereby enhancing therapeutic efficacy. The Italian healthcare system is increasingly recognizing the importance of tailored therapies, which is expected to boost the adoption of tissue microarrays in both research and clinical applications. This trend suggests a promising future for the tissue microarray market as precision medicine continues to gain traction.