Growing Awareness of Data Privacy

In Italy, the heightened awareness surrounding data privacy has emerged as a critical driver for the software defined-perimeter market. With the implementation of stringent data protection regulations, such as the GDPR, organizations are compelled to enhance their security frameworks. This regulatory landscape has led to a surge in demand for solutions that ensure data confidentiality and integrity. Recent surveys indicate that approximately 70% of Italian businesses are actively seeking to improve their data protection measures. As a result, the software defined-perimeter market is expected to expand as companies invest in technologies that align with privacy requirements and mitigate risks associated with data breaches.

Increased Focus on Network Segmentation

The emphasis on network segmentation is emerging as a pivotal driver for the software defined-perimeter market in Italy. Organizations are increasingly recognizing the importance of isolating sensitive data and applications to mitigate risks associated with cyber threats. This strategic approach not only enhances security but also improves compliance with regulatory requirements. Recent studies indicate that approximately 50% of Italian enterprises are implementing network segmentation strategies to bolster their security frameworks. As businesses prioritize the protection of critical assets, the software defined-perimeter market is likely to experience growth, driven by the demand for solutions that facilitate effective network segmentation.

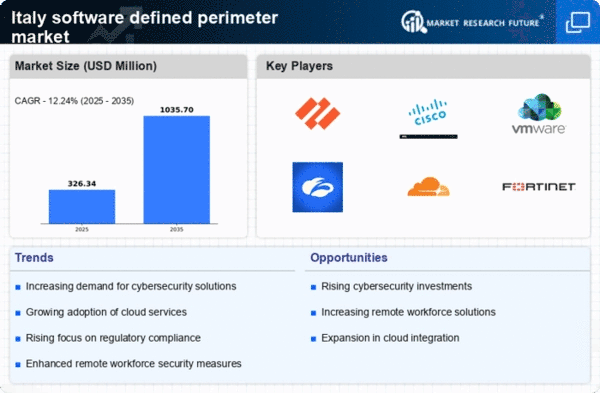

Rising Cloud Adoption Among Enterprises

The surge in cloud adoption among enterprises in Italy is significantly influencing the software defined-perimeter market. As organizations migrate to cloud-based infrastructures, the need for secure access to cloud resources becomes paramount. Recent data suggests that over 60% of Italian companies are utilizing cloud services, which necessitates the implementation of robust security measures to protect sensitive information. This trend is driving investments in software defined-perimeter solutions that facilitate secure cloud access while maintaining compliance with regulatory standards. As cloud adoption continues to rise, the software defined-perimeter market is poised for growth, catering to the security needs of cloud-centric enterprises.

Adoption of Advanced Security Technologies

The software defined-perimeter market is witnessing a significant uptick in the adoption of advanced security technologies in Italy. Organizations are increasingly recognizing the limitations of traditional security models, prompting a shift towards more dynamic and adaptive security solutions. The integration of artificial intelligence and machine learning into security frameworks is becoming commonplace, with a reported 40% of Italian firms planning to implement these technologies in the next year. This trend indicates a growing reliance on innovative security measures to combat evolving threats. Consequently, the software defined-perimeter market is likely to benefit from this technological evolution as businesses seek to enhance their security postures.

Increased Demand for Remote Work Solutions

The shift towards remote work has catalyzed a notable transformation in the software defined-perimeter market. Organizations in Italy are increasingly adopting remote work solutions, which necessitate robust security measures. This trend is evidenced by a reported 30% increase in remote work adoption among Italian companies in the past year. As businesses seek to protect sensitive data while enabling flexible work arrangements, the software defined-perimeter market is positioned to grow. The need for secure access to corporate resources from various locations drives investments in advanced security technologies. Consequently, the software defined-perimeter market is expected to see continued growth as organizations prioritize secure remote access solutions.