Growing Threat Landscape

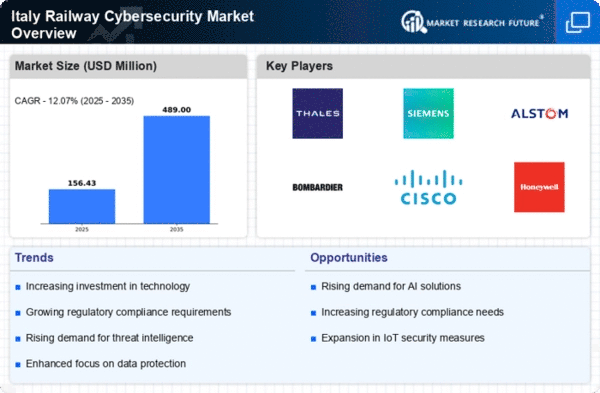

The railway cybersecurity market is experiencing heightened demand in Italy. is experiencing heightened demand due to an increasingly complex threat landscape. Cyberattacks targeting critical infrastructure have surged, with reports indicating a rise in incidents by over 30% in recent years. This alarming trend compels railway operators to invest in advanced cybersecurity measures to protect their systems from potential breaches. The need for robust security solutions is underscored by the reliance on digital technologies in railway operations, which, while enhancing efficiency, also introduces vulnerabilities. As a result, stakeholders in the railway sector are prioritizing cybersecurity investments to safeguard their assets and ensure uninterrupted service. This growing threat landscape is likely to drive the railway cybersecurity market forward, as organizations seek to mitigate risks and enhance their overall security posture.

Technological Advancements

Technological advancements play a pivotal role in shaping Technological advancements are shaping Increased regulatory scrutiny is influencing Public awareness regarding cybersecurity threats is rising in Italy.... The integration of Internet of Things (IoT) devices and smart technologies within railway systems has created new opportunities for enhancing operational efficiency. However, these innovations also introduce potential security vulnerabilities that must be addressed. The market is witnessing a shift towards adopting advanced cybersecurity solutions, such as artificial intelligence and machine learning, to proactively identify and mitigate threats. According to recent data, investments in AI-driven cybersecurity solutions are projected to grow by 25% annually. This trend indicates a strong commitment from railway operators to leverage cutting-edge technologies to fortify their cybersecurity frameworks. As the railway sector continues to evolve, the demand for sophisticated cybersecurity solutions is expected to rise, further propelling the railway cybersecurity market.

Increased Regulatory Scrutiny

In Italy, the railway cybersecurity market is significantly influenced by increased regulatory scrutiny. Authorities are implementing stringent regulations to ensure the safety and security of critical infrastructure, including railways. Compliance with these regulations is not merely a legal obligation but also a strategic necessity for railway operators. Failure to adhere to cybersecurity standards can result in severe penalties and reputational damage. Recent legislative developments have mandated that railway companies conduct regular cybersecurity assessments and implement comprehensive security measures. This regulatory environment is likely to drive investments in cybersecurity solutions, as organizations strive to meet compliance requirements while safeguarding their operations. The emphasis on regulatory compliance is expected to create a robust demand for cybersecurity services and products within the railway cybersecurity market.

Public Awareness and Safety Concerns

Public awareness regarding cybersecurity threats is rising in Italy, significantly impacting the railway cybersecurity market. As incidents of cyberattacks on critical infrastructure become more widely reported, public concern over safety and security is growing. This heightened awareness is prompting railway operators to prioritize cybersecurity initiatives to maintain public trust and ensure passenger safety. Surveys indicate that over 70% of travelers express concerns about the security of railway systems, which compels operators to enhance their cybersecurity measures. Consequently, investments in cybersecurity solutions are likely to increase as companies seek to address these concerns and demonstrate their commitment to safeguarding passengers. The interplay between public awareness and safety concerns is expected to drive the railway cybersecurity market, as stakeholders recognize the importance of protecting their systems against evolving threats.

Investment in Infrastructure Modernization

The ongoing investment in infrastructure modernization in Italy is a key driver of the railway cybersecurity market. As railway operators upgrade their systems to incorporate advanced technologies, the need for robust cybersecurity measures becomes increasingly critical. Modernized infrastructure often relies on interconnected systems, which, while improving efficiency, also heightens vulnerability to cyber threats. Recent reports suggest that investments in railway infrastructure are projected to exceed €10 billion over the next five years. This substantial financial commitment underscores the importance of integrating cybersecurity solutions into modernization efforts. As railway companies seek to enhance operational capabilities, they are also recognizing the necessity of protecting their assets from cyber risks. This dual focus on modernization and cybersecurity is likely to propel growth in the railway cybersecurity market, as organizations strive to create secure and resilient railway systems.