Aging Population

Italy's demographic shift towards an aging population significantly influences the oem patient-monitoring-vital-sign-oem-module market. With approximately 23% of the population aged 65 and older, the demand for healthcare services is escalating. Older adults typically require more frequent monitoring of vital signs, leading to an increased need for reliable and efficient monitoring solutions. This demographic trend suggests that healthcare providers will likely invest in oem patient-monitoring-vital-sign-oem-modules to cater to the specific needs of elderly patients. As a result, the market is poised for growth, driven by the necessity for enhanced monitoring capabilities to manage chronic conditions prevalent among older individuals.

Rising Healthcare Expenditure

The increasing healthcare expenditure in Italy is a pivotal driver for the oem patient-monitoring-vital-sign-oem-module market. As the Italian government allocates more funds towards healthcare, the demand for advanced monitoring solutions is likely to rise. In 2025, healthcare spending is projected to reach approximately €200 billion, reflecting a growth of around 5% from previous years. This financial commitment enables hospitals and healthcare facilities to invest in innovative technologies, including patient monitoring systems. Consequently, the oem patient-monitoring-vital-sign-oem-module market is expected to benefit from this trend, as healthcare providers seek to enhance patient care and operational efficiency through the adoption of sophisticated monitoring modules.

Focus on Preventive Healthcare

The growing emphasis on preventive healthcare in Italy is driving the oem patient-monitoring-vital-sign-oem-module market. As healthcare policies shift towards prevention rather than treatment, there is a rising demand for monitoring solutions that facilitate early detection of health issues. This trend is reflected in the Italian healthcare system's initiatives aimed at reducing hospital admissions and improving overall public health. By investing in oem patient-monitoring-vital-sign-oem-modules, healthcare providers can monitor patients' vital signs more effectively, leading to timely interventions. This proactive approach is expected to enhance the market's growth, as more facilities adopt these technologies to align with preventive healthcare strategies.

Increased Investment in Telehealth

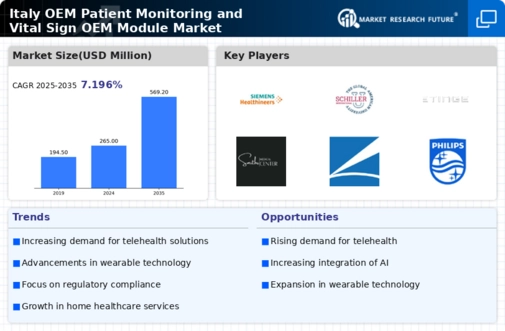

The surge in telehealth services in Italy is a significant driver for the oem patient-monitoring-vital-sign-oem-module market. As healthcare providers expand their telehealth offerings, the need for reliable monitoring solutions becomes paramount. In 2025, the telehealth market in Italy is anticipated to reach €1 billion, indicating a robust growth trajectory. This expansion necessitates the integration of oem patient-monitoring-vital-sign-oem-modules to ensure that healthcare professionals can effectively monitor patients remotely. The convenience and efficiency of telehealth services are likely to propel the demand for these monitoring solutions, thereby fostering growth within the oem patient-monitoring-vital-sign-oem-module market.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is a crucial driver for the oem patient-monitoring-vital-sign-oem-module market. Innovations such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) are transforming patient monitoring systems. In Italy, the adoption of these technologies is gaining momentum, with a projected market growth rate of 8% annually for smart healthcare solutions. This technological evolution enables healthcare providers to offer more accurate and timely monitoring of vital signs, thereby improving patient outcomes. As hospitals and clinics increasingly seek to implement these advanced systems, the oem patient-monitoring-vital-sign-oem-module market is likely to experience substantial growth.