Focus on Cost Efficiency

Cost efficiency remains a significant driver in the healthcare regulatory-affairs-outsourcing market. Italian healthcare organizations are under pressure to reduce operational costs while maintaining compliance with regulatory standards. Outsourcing regulatory affairs functions allows companies to leverage specialized expertise without the overhead associated with in-house teams. By outsourcing, firms can potentially save up to 30% on operational costs, which is particularly appealing in a competitive market. This financial incentive encourages more organizations to consider outsourcing as a viable strategy. As the healthcare landscape continues to evolve, the emphasis on cost efficiency is likely to drive further growth in the outsourcing market, as companies seek to optimize their resources while ensuring compliance.

Rising Complexity of Regulations

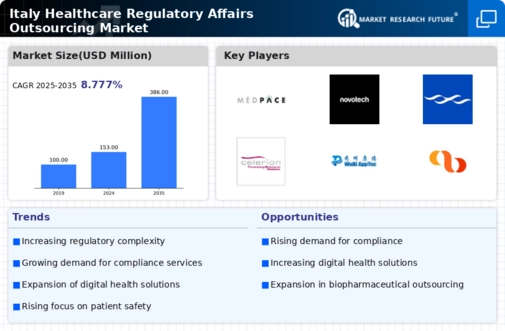

The increasing complexity of healthcare regulations in Italy is a primary driver for the healthcare regulatory-affairs-outsourcing market. As regulatory frameworks evolve, companies face challenges in compliance, necessitating specialized expertise. The Italian Medicines Agency (AIFA) has implemented stringent guidelines that require thorough understanding and navigation. This complexity compels organizations to seek outsourcing solutions to ensure adherence to regulations, thereby reducing the risk of penalties. The market is projected to grow as firms increasingly rely on external partners to manage compliance, with estimates suggesting a growth rate of approximately 8% annually. This trend indicates a robust demand for regulatory affairs services, as companies prioritize compliance to maintain market access and protect their reputations.

Increased Focus on Patient Safety

Patient safety has become a paramount concern in the healthcare sector, influencing the healthcare regulatory-affairs-outsourcing market. Regulatory bodies in Italy are intensifying their scrutiny of clinical trials and product approvals to ensure that patient safety is prioritized. This heightened focus necessitates comprehensive regulatory oversight, which can be resource-intensive for organizations. Consequently, many companies are turning to outsourcing partners that specialize in regulatory affairs to navigate these complexities effectively. The demand for services that enhance patient safety compliance is expected to rise, potentially increasing the market size by 10% over the next few years. This trend underscores the critical role of regulatory affairs in safeguarding public health and maintaining trust in healthcare systems.

Growing Demand for Market Access Strategies

The growing demand for effective market access strategies is a crucial driver in the healthcare regulatory-affairs-outsourcing market. As competition intensifies, companies in Italy are seeking ways to expedite their entry into the market while ensuring compliance with regulatory requirements. Outsourcing regulatory affairs functions allows organizations to tap into the expertise of specialized firms that understand the nuances of market access. This trend is particularly relevant for pharmaceutical and biotechnology companies aiming to launch new products efficiently. The market for regulatory affairs outsourcing is expected to expand as firms increasingly recognize the value of strategic partnerships in navigating the complexities of market access, potentially leading to a growth rate of 7% in the coming years.

Technological Advancements in Compliance Tools

Technological advancements are reshaping the landscape of the healthcare regulatory-affairs-outsourcing market. The integration of advanced compliance tools and software solutions streamlines regulatory processes. This makes it easier for organizations to manage compliance efficiently. In Italy, the adoption of digital platforms for regulatory submissions and monitoring is on the rise, allowing for real-time tracking and reporting. This technological shift not only enhances efficiency but also reduces the likelihood of errors in compliance documentation. As companies increasingly recognize the benefits of these technologies, the demand for outsourcing services that incorporate these tools is likely to grow. The market could see a significant uptick as firms seek to leverage technology to improve their regulatory affairs capabilities.