Emergence of IoT Applications

The rapid emergence of Internet of Things (IoT) applications in Italy is driving the growth of the fpga in-telecom-sector market. As IoT devices proliferate, the demand for robust and efficient communication networks becomes paramount. FPGAs are particularly well-suited for handling the diverse and dynamic requirements of IoT applications, enabling telecom operators to manage large volumes of data with low latency. The Italian IoT market is expected to reach €10 billion by 2026, indicating a substantial opportunity for FPGAs to play a critical role in network infrastructure. This trend suggests that as IoT continues to expand, the fpga in-telecom-sector market will likely experience increased demand for adaptable and scalable solutions that can support the growing number of connected devices.

Growing Focus on Edge Computing

The growing focus on edge computing in Italy is emerging as a significant driver for the fpga in-telecom-sector market. As data processing increasingly shifts closer to the source of data generation, telecom operators are seeking solutions that can efficiently handle this decentralized approach. FPGAs are particularly advantageous in edge computing scenarios due to their ability to process data in real-time with minimal latency. This trend is expected to gain momentum as more industries adopt edge computing strategies, potentially leading to a market growth rate of 6.5% in the coming years. Consequently, the fpga in-telecom-sector market is likely to see heightened demand for FPGAs that can support the unique requirements of edge computing applications.

Government Initiatives and Investments

Government initiatives aimed at enhancing digital infrastructure in Italy are significantly influencing the fpga in-telecom-sector market. The Italian government has launched various programs to promote the expansion of broadband services, particularly in underserved areas. These initiatives often include financial incentives for telecom companies to adopt advanced technologies, including FPGAs, which can facilitate faster deployment and improved service quality. For instance, the Italian Ministry of Economic Development has allocated €1 billion for digital infrastructure projects, which is likely to spur investments in FPGAs. This governmental support not only accelerates the adoption of FPGAs but also fosters innovation within the telecom sector, ultimately enhancing the overall market landscape for FPGAs in telecommunications.

Rising Demand for High-Speed Connectivity

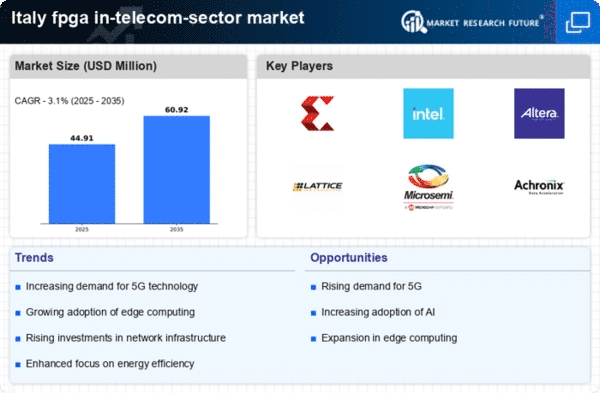

The increasing demand for high-speed connectivity in Italy is a primary driver for the fpga in-telecom-sector market. As consumers and businesses alike seek faster internet services, telecom providers are compelled to upgrade their infrastructure. This shift necessitates the deployment of advanced technologies, including FPGAs, which offer the flexibility and performance required for high-speed data processing. According to recent data, the Italian telecommunications sector is projected to grow at a CAGR of 5.2% from 2025 to 2030, further emphasizing the need for efficient solutions. FPGAs enable telecom operators to enhance their network capabilities, thereby meeting the escalating expectations of users for seamless connectivity. The fpga in-telecom-sector market is thus positioned to benefit significantly from this trend, as operators invest in upgrading their systems to accommodate the growing demand.

Shift Towards Virtualized Network Functions

The shift towards virtualized network functions (VNFs) in Italy is a notable driver for the fpga in-telecom-sector market. Telecom operators are increasingly adopting virtualization to enhance network efficiency and reduce operational costs. FPGAs provide the necessary processing power and flexibility to support VNFs, allowing for the rapid deployment of new services without the need for extensive hardware changes. This transition is expected to streamline operations and improve service delivery, making FPGAs an attractive option for telecom providers. As the Italian telecom market continues to evolve, the integration of FPGAs into virtualized environments is likely to become more prevalent, thereby bolstering the fpga in-telecom-sector market.