Rising Demand for Air Travel

The commercial aircraft-gas-turbine-engine market in Italy is experiencing a notable surge in demand for air travel, driven by an increase in both domestic and international tourism. According to recent data, air passenger traffic in Italy is projected to grow by approximately 4% annually over the next five years. This growth is prompting airlines to expand their fleets, thereby increasing the demand for new aircraft and, consequently, gas turbine engines. The rising demand for air travel not only stimulates the market but also encourages manufacturers to enhance their production capabilities. As airlines seek to modernize their fleets with more fuel-efficient engines, the commercial aircraft-gas-turbine-engine market is likely to witness substantial growth, creating opportunities for innovation and investment.

Regulatory Compliance and Standards

The commercial aircraft-gas-turbine-engine market in Italy is influenced by stringent regulatory compliance and standards set by both national and international aviation authorities. These regulations often mandate specific emissions and noise levels, compelling manufacturers to innovate and adapt their engines accordingly. For instance, the European Union has established regulations that require a reduction in CO2 emissions by 30% by 2030. This regulatory landscape drives investment in research and development, as companies strive to meet these standards while maintaining performance. The need for compliance not only affects the design and manufacturing processes but also influences the overall market dynamics, as companies that can effectively navigate these regulations may gain a competitive edge in the commercial aircraft-gas-turbine-engine market.

Investment in Infrastructure Development

Investment in infrastructure development is a critical driver for the commercial aircraft-gas-turbine-engine market in Italy. The Italian government has been actively investing in airport expansions and upgrades, which are essential for accommodating the growing number of air travelers. This infrastructure development not only enhances the operational capacity of airports but also stimulates demand for new aircraft and engines. For instance, the expansion of major airports like Rome Fiumicino and Milan Malpensa is expected to increase air traffic capacity significantly. As airlines respond to this increased capacity by acquiring new aircraft, the demand for gas turbine engines is likely to rise, thereby positively impacting the commercial aircraft-gas-turbine-engine market.

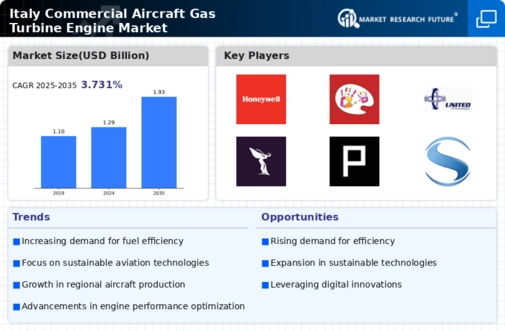

Competitive Landscape and Market Dynamics

The competitive landscape of the commercial aircraft-gas-turbine-engine market in Italy is characterized by the presence of several key players, each vying for market share through innovation and strategic partnerships. Major manufacturers are increasingly focusing on developing more efficient and environmentally friendly engines to meet the evolving needs of airlines. This competitive environment encourages continuous improvement and drives technological advancements within the market. Additionally, collaborations between manufacturers and research institutions are becoming more common, facilitating the exchange of knowledge and resources. As competition intensifies, companies that can effectively differentiate their products and demonstrate superior performance are likely to thrive in the commercial aircraft-gas-turbine-engine market.

Technological Innovations in Engine Design

Technological innovations play a pivotal role in shaping the commercial aircraft-gas-turbine-engine market in Italy. Advancements in materials science, such as the development of lightweight composite materials, are enabling manufacturers to produce engines that are not only more efficient but also more durable. Furthermore, innovations in digital technologies, including predictive maintenance and advanced simulation techniques, are enhancing the performance and reliability of gas turbine engines. These technological advancements are crucial as they allow manufacturers to meet the increasing demands for fuel efficiency and reduced emissions. As a result, the commercial aircraft-gas-turbine-engine market is likely to see a shift towards more advanced engine designs that incorporate these innovations, ultimately benefiting both manufacturers and airlines.