Italy Celiac Disease Treatment Market Summary

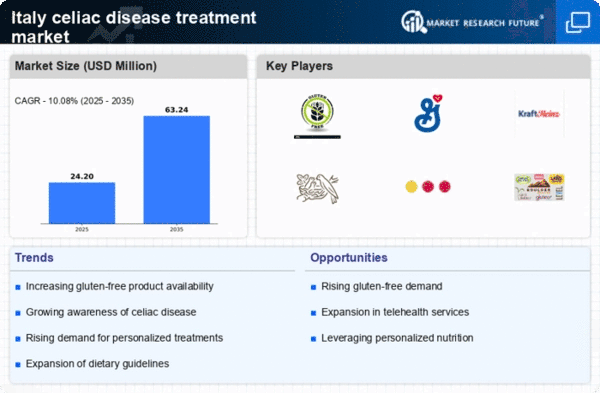

As per Market Research Future analysis, the Italy Celiac Disease Treatment Market size was estimated at 21.98 USD Million in 2024. The Celiac Disease-treatment market is projected to grow from 24.2 USD Million in 2025 to 63.24 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 10.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Italy celiac disease-treatment market is experiencing notable growth driven by increasing awareness and demand for gluten-free options.

- The market is witnessing a rising demand for gluten-free products, particularly in the largest segment of dietary supplements.

- Regulatory changes are enhancing product safety, which is crucial for the fastest-growing segment of gluten-free food products.

- There is an increased focus on patient education, which is vital for improving treatment adherence and outcomes.

- Key market drivers include growing awareness of celiac disease and advancements in diagnostic technologies, which are propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 21.98 (USD Million) |

| 2035 Market Size | 63.24 (USD Million) |

| CAGR (2025 - 2035) | 10.08% |

Major Players

Gluten Free Holdings (US), General Mills (US), Kraft Heinz (US), Nestle (CH), Dr. Schar (IT), Boulder Brands (US), Canyon Bakehouse (US), Udi's Gluten Free (US)