Regulatory Support for Chemical Products

Regulatory support for chemical products is a significant driver for the Iprodione Market. Governments and agricultural agencies are increasingly recognizing the importance of fungicides in maintaining crop health and productivity. This regulatory backing often translates into streamlined approval processes for new formulations and uses of Iprodione. As regulations evolve to support sustainable agricultural practices, the market for Iprodione is likely to see increased investment and innovation. The alignment of regulatory frameworks with agricultural needs can foster a more favorable environment for the growth of the Iprodione Market, ensuring that farmers have access to effective crop protection solutions.

Technological Advancements in Agriculture

Technological advancements in agriculture are significantly influencing the Iprodione Market. Innovations such as precision agriculture and integrated pest management are enhancing the application efficiency of fungicides. These technologies allow for targeted application, reducing waste and improving crop yields. Furthermore, the introduction of advanced formulations of Iprodione is expected to increase its effectiveness and safety profile. As farmers increasingly adopt these technologies, the demand for Iprodione is likely to rise, contributing to the overall growth of the Iprodione Market. The integration of technology in farming practices is anticipated to reshape the landscape of agricultural inputs.

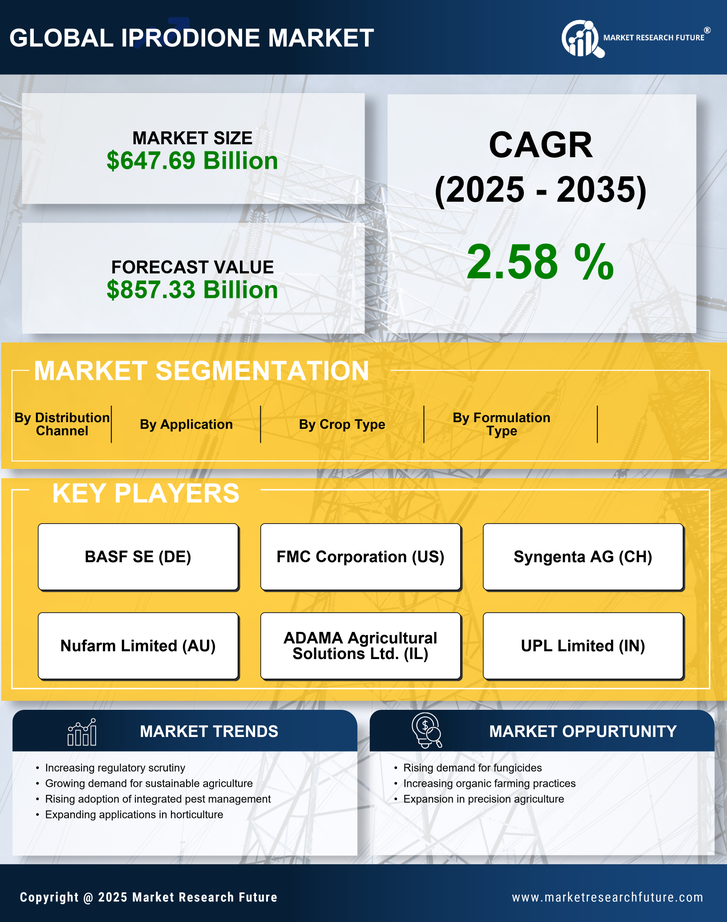

Rising Demand for Crop Protection Solutions

The Iprodione Market is experiencing a notable increase in demand for effective crop protection solutions. This trend is largely driven by the need to enhance agricultural productivity and ensure food security. As farmers face challenges from pests and diseases, the adoption of fungicides like Iprodione becomes essential. Recent data indicates that The Iprodione is projected to reach USD 20 billion by 2026, with Iprodione playing a crucial role in this growth. The efficacy of Iprodione against a wide range of fungal pathogens makes it a preferred choice among agricultural professionals, thereby propelling the Iprodione Market forward.

Increasing Awareness of Plant Health Management

The Iprodione Market is benefiting from a growing awareness of plant health management among farmers and agricultural stakeholders. This awareness is leading to a more proactive approach in managing crop diseases, with Iprodione being recognized for its effectiveness in controlling various fungal infections. Educational initiatives and extension services are promoting the importance of using fungicides as part of an integrated disease management strategy. As a result, the market for Iprodione is expected to expand, with more farmers incorporating it into their crop protection programs. This shift towards a more informed approach to plant health is likely to enhance the overall efficacy of agricultural practices.

Expansion of Agricultural Land and Crop Diversity

The expansion of agricultural land and crop diversity is contributing to the growth of the Iprodione Market. As more land is cultivated and farmers diversify their crops, the need for effective disease management solutions becomes paramount. Iprodione, with its broad-spectrum activity against various fungal pathogens, is well-positioned to meet this demand. Recent statistics suggest that the area under cultivation is expected to increase by approximately 5% over the next five years, which could lead to a corresponding rise in the use of fungicides like Iprodione. This trend indicates a robust potential for growth within the Iprodione Market as it adapts to the evolving agricultural landscape.