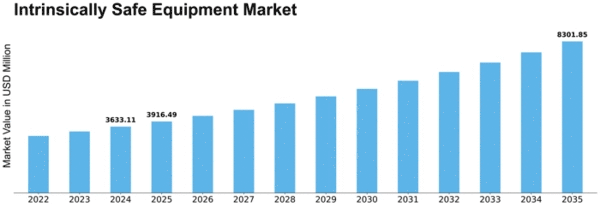

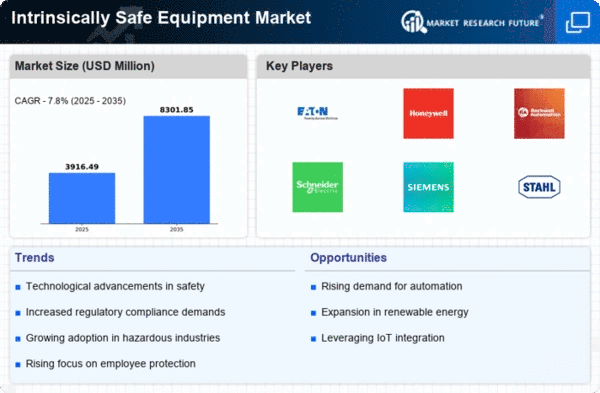

Intrinsically Safe Equipment Size

Intrinsically Safe Equipment Market Growth Projections and Opportunities

The market for intrinsically safe equipment is influenced by several key factors that shape its dynamics and growth trajectory. One crucial determinant is the stringent safety regulations and standards prevalent in various industries. The need to ensure worker safety in hazardous environments has led to a rising demand for intrinsically safe equipment, which is specifically designed to prevent the initiation of explosions or fires. As regulatory bodies continue to emphasize the importance of workplace safety, companies across industries such as oil and gas, chemicals, mining, and manufacturing are increasingly adopting these safety-compliant devices.

Technological advancements also play a pivotal role in shaping the market for intrinsically safe equipment. As industries embrace digitalization and automation, the demand for technologically advanced intrinsically safe devices is on the rise. Manufacturers are continuously innovating to enhance the performance, efficiency, and connectivity of intrinsically safe equipment. This technological evolution not only meets the safety requirements but also provides additional features, contributing to the overall market growth.

The global energy landscape is another critical factor influencing the market for intrinsically safe equipment. The increasing exploration and production activities in the oil and gas sector, coupled with the expansion of renewable energy projects, drive the demand for intrinsically safe devices. These industries often involve volatile substances and challenging environments, necessitating the use of equipment that ensures safety without compromising operational efficiency.

Market factors are also shaped by the growing awareness and emphasis on corporate social responsibility (CSR) and sustainable practices. Companies are becoming more conscious of their environmental impact and are inclined towards adopting technologies that align with sustainable development goals. Intrinsically safe equipment, by its nature, contributes to both workplace safety and environmental sustainability, making it an attractive choice for businesses striving to meet these objectives.

Moreover, geopolitical and economic factors play a significant role in the market dynamics of intrinsically safe equipment. Regions with high industrial activities and a focus on safety regulations become key markets for these products. Economic growth, industrialization, and infrastructure development in emerging markets contribute to the expansion of the intrinsically safe equipment market. Additionally, fluctuations in commodity prices, currency exchange rates, and global economic conditions can impact investment decisions and, consequently, the adoption of intrinsically safe devices.

The competitive landscape also influences market dynamics. The presence of established players, their product portfolios, and strategic collaborations contribute to the overall competitiveness of the market. Continuous research and development activities, mergers and acquisitions, and partnerships among manufacturers are common strategies to gain a competitive edge in the intrinsically safe equipment market.

Customer preferences and evolving industry requirements further shape the market landscape. End-users prioritize features such as reliability, durability, and ease of integration when selecting intrinsically safe equipment. As industries evolve, the demand for customization and flexibility in intrinsically safe solutions also becomes a significant factor driving market trends.

Leave a Comment