Focus on Cost Reduction

Cost reduction remains a primary objective for businesses within the Intralogistics Automation Solution Market. Organizations are increasingly recognizing that automation can lead to substantial savings in labor costs, operational expenses, and error-related costs. By automating repetitive tasks, companies can allocate their workforce to more strategic roles, thereby enhancing productivity. Market analysis suggests that businesses that invest in automation technologies can achieve a return on investment (ROI) within a relatively short timeframe. This focus on cost efficiency is driving the adoption of automated solutions in warehousing, distribution, and manufacturing sectors. As companies strive to maintain profitability in a competitive landscape, the demand for cost-effective intralogistics automation solutions is expected to grow.

Growing E-commerce Sector

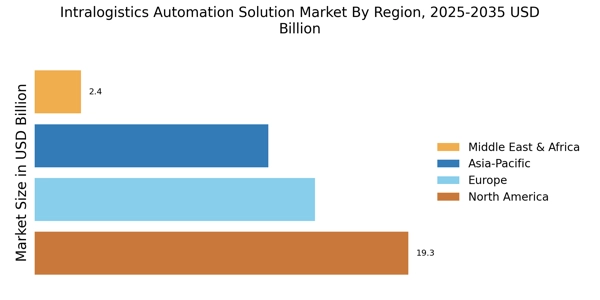

The rapid expansion of the e-commerce sector is a key driver for the Intralogistics Automation Solution Market. With the increasing volume of online orders, businesses are compelled to adopt automation solutions to manage their logistics more effectively. Data indicates that e-commerce sales have been growing at an unprecedented rate, with projections estimating that they will account for a significant portion of total retail sales in the near future. This shift necessitates the implementation of automated systems for order processing, inventory management, and last-mile delivery. Companies that leverage intralogistics automation can enhance their responsiveness to customer demands, reduce delivery times, and improve overall service quality. As e-commerce continues to thrive, the reliance on automation solutions in logistics will likely intensify.

Technological Advancements

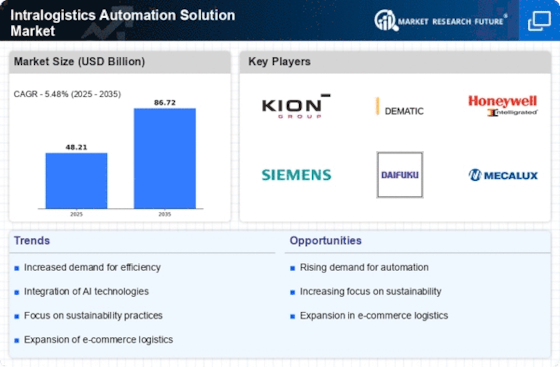

Technological advancements play a pivotal role in shaping the Intralogistics Automation Solution Market. Innovations in robotics, artificial intelligence, and the Internet of Things (IoT) are transforming traditional logistics processes. For instance, the introduction of autonomous mobile robots (AMRs) has revolutionized warehouse operations, allowing for real-time inventory tracking and efficient material transport. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years. These advancements not only enhance operational efficiency but also improve safety and accuracy in logistics operations. As technology continues to evolve, the demand for sophisticated automation solutions is likely to increase, further propelling the growth of the intralogistics automation sector.

Rising Demand for Efficiency

The Intralogistics Automation Solution Market is experiencing a notable surge in demand for efficiency across various sectors. Companies are increasingly seeking to optimize their supply chain operations, which has led to a heightened interest in automation solutions. According to recent data, organizations that implement intralogistics automation can achieve efficiency gains of up to 30%. This trend is driven by the need to reduce operational costs and improve service levels. As businesses strive to remain competitive, the adoption of automated systems for material handling, inventory management, and order fulfillment is becoming essential. The integration of advanced technologies such as artificial intelligence and machine learning further enhances the capabilities of these solutions, making them indispensable in modern logistics operations.

Increased Regulatory Compliance

The need for increased regulatory compliance is influencing the Intralogistics Automation Solution Market. As industries face stricter regulations regarding safety, quality, and environmental standards, the adoption of automation solutions is becoming a strategic necessity. Automated systems can help organizations ensure compliance by providing accurate data tracking, reporting capabilities, and process standardization. This is particularly relevant in sectors such as pharmaceuticals and food and beverage, where adherence to regulations is critical. The market is witnessing a shift towards solutions that not only enhance operational efficiency but also facilitate compliance with industry standards. As regulatory pressures continue to mount, the demand for intralogistics automation solutions that support compliance efforts is likely to rise.