Increased Demand for Efficiency

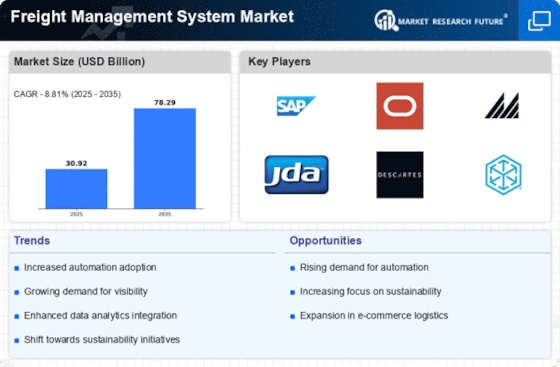

The Freight Management System Market is experiencing a surge in demand for enhanced operational efficiency. Companies are increasingly seeking solutions that streamline logistics processes, reduce transit times, and minimize costs. According to recent data, organizations that implement advanced freight management systems can achieve up to a 20% reduction in operational costs. This drive towards efficiency is fueled by the need for businesses to remain competitive in a rapidly evolving marketplace. As a result, the Freight Management System Market is witnessing a growing adoption of technologies that facilitate real-time tracking, automated reporting, and data analytics, which collectively contribute to improved decision-making and resource allocation.

Growth of E-commerce and Online Retail

The Freight Management System Market is witnessing substantial growth driven by the expansion of e-commerce and online retail. As consumer preferences shift towards online shopping, logistics and freight management have become critical components of the supply chain. Data indicates that e-commerce sales have been growing at an annual rate of over 15%, necessitating efficient freight management solutions to handle increased shipment volumes. This trend compels businesses to adopt advanced freight management systems that can accommodate the complexities of last-mile delivery, inventory management, and order fulfillment. The Freight Management System Market is thus evolving to meet the demands of a digital economy, where speed and reliability are paramount.

Technological Advancements in Logistics

The Freight Management System Market is significantly shaped by ongoing technological advancements in logistics. Innovations such as artificial intelligence, machine learning, and the Internet of Things (IoT) are transforming traditional freight management practices. These technologies enable real-time data collection and analysis, predictive analytics, and automated decision-making processes. As a result, companies are increasingly adopting freight management systems that leverage these technologies to enhance visibility, optimize routes, and improve customer service. The integration of such advanced technologies is expected to drive the Freight Management System Market forward, as organizations seek to harness the power of data to gain a competitive edge.

Regulatory Compliance and Safety Standards

The Freight Management System Market is significantly influenced by the need for compliance with various regulatory frameworks and safety standards. Governments and regulatory bodies are increasingly imposing stringent regulations on transportation and logistics operations, necessitating the adoption of robust freight management systems. These systems help organizations ensure adherence to safety protocols, environmental regulations, and trade compliance. For instance, the implementation of electronic logging devices (ELDs) has become mandatory in many regions, driving the demand for integrated freight management solutions. Consequently, companies are investing in systems that not only enhance compliance but also improve overall operational safety, thereby fostering a more secure logistics environment.

Focus on Sustainability and Green Logistics

The Freight Management System Market is increasingly influenced by a growing focus on sustainability and green logistics. Companies are recognizing the importance of reducing their carbon footprint and are actively seeking solutions that promote environmentally friendly practices. This shift is prompting the adoption of freight management systems that optimize transportation routes, reduce fuel consumption, and minimize waste. According to industry reports, organizations that implement sustainable logistics practices can achieve a reduction in greenhouse gas emissions by up to 30%. As sustainability becomes a core business strategy, the Freight Management System Market is likely to see a rise in demand for solutions that align with these environmental goals.