North America : Market Leader in Catheters

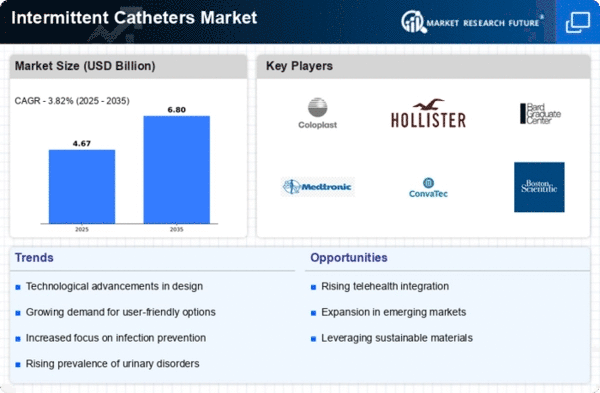

North America is poised to maintain its leadership in the Intermittent Catheters Market, holding a significant market share of 2.25 billion in 2024. The growth is driven by an aging population, increasing prevalence of urinary disorders, and advancements in catheter technology. Regulatory support from health authorities further enhances market dynamics, ensuring safety and efficacy in catheter use. The competitive landscape is robust, with key players like Coloplast, Hollister, and Bard leading the charge. The U.S. is the primary market, supported by a strong healthcare infrastructure and high demand for innovative medical devices. Companies are focusing on product development and strategic partnerships to enhance their market presence, ensuring a diverse range of options for consumers.

Europe : Emerging Market Potential

Europe's Intermittent Catheters Market is valued at 1.2 billion, reflecting a growing demand driven by increasing awareness of urinary health and supportive healthcare policies. The region benefits from a well-established healthcare system and regulatory frameworks that promote innovation and patient safety. Countries like Germany and the UK are leading the market, with a focus on improving patient outcomes through advanced catheter technologies. The competitive landscape features major players such as ConvaTec and Boston Scientific, who are investing in research and development to meet the evolving needs of patients. The presence of strong distribution networks and partnerships with healthcare providers further enhances market accessibility. As the region continues to embrace technological advancements, the market is expected to expand significantly.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region, with a market size of 0.9 billion, is witnessing rapid growth in the Intermittent Catheters Market. Factors such as rising healthcare expenditure, increasing awareness of urinary health, and a growing elderly population are driving demand. Regulatory bodies are also playing a crucial role in ensuring product safety and efficacy, which is vital for market expansion. Leading countries like Japan and Australia are at the forefront, supported by a mix of local and international players. Companies such as Medtronic and Teleflex are actively expanding their presence in this region, focusing on innovative solutions tailored to local needs. The competitive landscape is evolving, with an emphasis on partnerships and collaborations to enhance market reach and product offerings.

Middle East and Africa : Emerging Healthcare Landscape

The Middle East and Africa (MEA) region, with a market size of 0.15 billion, presents unique growth opportunities in the Intermittent Catheters Market. The increasing prevalence of urinary disorders and a growing focus on improving healthcare infrastructure are key drivers. Regulatory initiatives aimed at enhancing healthcare quality are also contributing to market growth, fostering a more favorable environment for medical device adoption. Countries like South Africa and the UAE are leading the charge, with a mix of local and international players entering the market. Companies such as Smiths Medical and Amsino International are focusing on expanding their product lines to cater to the diverse needs of the region. The competitive landscape is characterized by strategic partnerships and investments aimed at enhancing market penetration and improving patient care.