Regulatory Changes and Compliance Requirements

The evolving regulatory landscape surrounding intellectual property rights is a key driver for the Intellectual Property Software Market Industry. Governments and international bodies are continuously updating laws and regulations to enhance the protection of intellectual property. This dynamic environment necessitates that businesses remain compliant with these changes, which can be complex and resource-intensive. Consequently, organizations are turning to software solutions that can streamline compliance processes and ensure adherence to legal requirements. The market for compliance-focused intellectual property software is projected to grow, as companies seek to mitigate risks associated with non-compliance and potential legal disputes.

Technological Advancements in Software Solutions

Technological innovations are significantly influencing the Intellectual Property Software Market Industry. The advent of advanced analytics, machine learning, and blockchain technology is reshaping how intellectual property is managed. These technologies enable more efficient patent searches, trademark registrations, and copyright management. For instance, the integration of machine learning algorithms allows for predictive analytics, which can forecast potential infringement risks. As a result, organizations are increasingly adopting sophisticated software solutions that leverage these advancements. The market is expected to witness a surge in demand for such innovative tools, as they provide enhanced accuracy and efficiency in managing intellectual property portfolios.

Rising Demand for Intellectual Property Protection

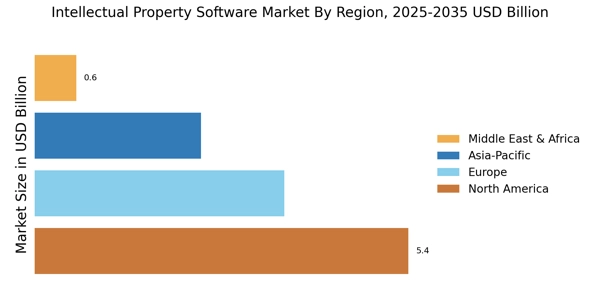

The increasing awareness of the importance of intellectual property rights is driving the Intellectual Property Software Market Industry. As businesses recognize the value of their innovations, the demand for software solutions that can effectively manage and protect these assets is surging. In 2025, the market is projected to reach a valuation of approximately 5 billion USD, reflecting a compound annual growth rate of around 10%. This growth is fueled by the need for organizations to safeguard their intellectual property against infringement and unauthorized use. Consequently, companies are investing in software that offers comprehensive tracking, management, and enforcement capabilities, thereby enhancing their competitive edge in the marketplace.

Increase in Cross-Border Intellectual Property Transactions

The rise in cross-border transactions involving intellectual property is significantly impacting the Intellectual Property Software Market Industry. As businesses expand their operations internationally, the need for effective management of intellectual property across different jurisdictions becomes critical. This trend is leading to an increased demand for software solutions that can handle the complexities of international intellectual property laws and regulations. In 2025, it is anticipated that the volume of cross-border intellectual property transactions will increase by approximately 15%, further driving the need for specialized software. Organizations are seeking tools that can facilitate seamless management of their intellectual property portfolios on a global scale.

Growing Importance of Intellectual Property in Business Strategy

The strategic role of intellectual property in business operations is becoming more pronounced, thereby propelling the Intellectual Property Software Market Industry. Companies are increasingly recognizing that robust intellectual property management can lead to competitive advantages and revenue generation. In 2025, it is estimated that over 70% of businesses will incorporate intellectual property considerations into their strategic planning. This shift is prompting organizations to seek software solutions that facilitate the identification, valuation, and monetization of their intellectual assets. As a result, the demand for comprehensive intellectual property management software is likely to increase, reflecting a broader trend towards strategic asset management.