Globalization and Market Expansion

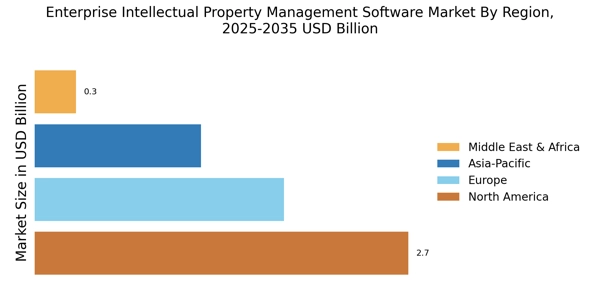

As businesses expand into new markets, the need for effective intellectual property management becomes more pronounced. The Enterprise Intellectual Property Management Software Market Industry is benefiting from globalization, as companies seek to protect their IP assets across diverse jurisdictions. This trend is particularly relevant for multinational corporations that must navigate varying legal landscapes. The software solutions that facilitate this process are increasingly in demand, as they provide the necessary tools for managing IP portfolios on a global scale. The market is expected to grow as organizations recognize the importance of a cohesive IP strategy in supporting their international operations.

Increased Focus on Innovation and R&D

The emphasis on innovation and research and development (R&D) is a significant driver for the Enterprise Intellectual Property Management Software Market Industry. Companies are investing heavily in R&D to stay competitive, leading to a surge in the creation of new intellectual property. This trend necessitates robust management solutions to track and protect these assets effectively. As organizations prioritize innovation, the demand for software that can streamline IP processes and enhance collaboration among R&D teams is expected to rise. The market is poised for growth as businesses recognize the critical role of effective IP management in fostering innovation.

Regulatory Compliance and Legal Frameworks

The evolving landscape of regulatory compliance is a critical driver for the Enterprise Intellectual Property Management Software Market Industry. Organizations are increasingly required to adhere to stringent legal frameworks governing intellectual property rights. This necessitates the implementation of sophisticated software solutions that can manage compliance effectively. The market is witnessing a surge in demand for tools that facilitate tracking, reporting, and managing IP assets in accordance with local and international regulations. As businesses navigate these complexities, the software industry is likely to see a corresponding increase in adoption rates, reflecting the importance of compliance in maintaining competitive advantage.

Technological Advancements in IP Management

The rapid advancement of technology is reshaping the Enterprise Intellectual Property Management Software Market Industry. Innovations such as artificial intelligence and machine learning are being integrated into IP management solutions, enhancing their capabilities. These technologies enable organizations to automate routine tasks, analyze large datasets, and gain insights into IP trends. As a result, companies are more inclined to invest in advanced software that can improve efficiency and decision-making processes. The market is likely to see continued growth as organizations leverage these technological advancements to optimize their IP management strategies.

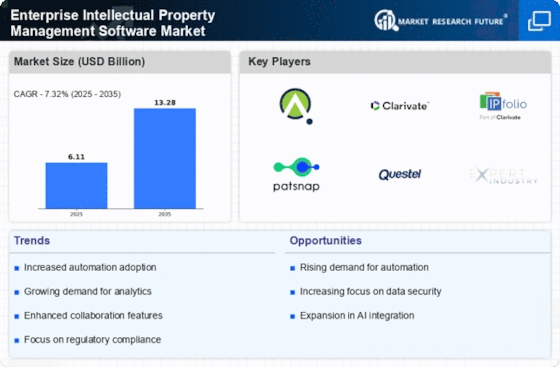

Rising Demand for Intellectual Property Protection

The increasing complexity of intellectual property rights has led to a heightened demand for effective management solutions. Organizations are recognizing the necessity of safeguarding their innovations and proprietary information. This trend is particularly evident in industries such as technology and pharmaceuticals, where the value of intellectual property is paramount. The Enterprise Intellectual Property Management Software Market Industry is experiencing growth as companies seek to streamline their IP processes, ensuring compliance and reducing the risk of infringement. As of 2025, the market is projected to expand significantly, driven by the need for robust IP strategies that align with business objectives.