Regulatory Compliance

Stringent regulatory frameworks governing maritime operations are driving the Global Integrated Bridge System for Ships Industry. Compliance with international safety and environmental standards necessitates the adoption of advanced bridge systems. For example, the International Maritime Organization has set guidelines that require vessels to implement systems that enhance navigational safety and reduce environmental impact. This regulatory pressure is likely to propel market growth, as ship operators seek to avoid penalties and ensure compliance. By 2035, the market is expected to expand to 9.43 USD Billion, indicating a robust response to regulatory demands.

Increased Maritime Trade

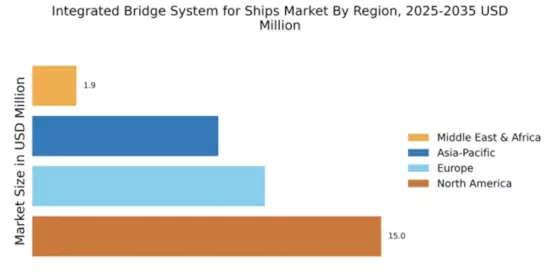

The Global Integrated Bridge System for Ships Industry is benefiting from the growth in global maritime trade. As international trade volumes rise, there is a corresponding need for efficient and reliable navigation systems. Enhanced bridge systems facilitate smoother operations, reducing transit times and improving overall logistics. The increase in shipping activities, particularly in emerging markets, suggests a sustained demand for advanced bridge technologies. This trend is expected to contribute to a compound annual growth rate of 4.42% from 2025 to 2035, underscoring the importance of integrated systems in modern shipping.

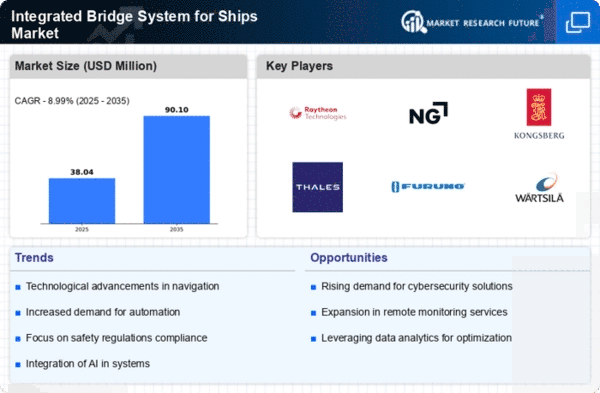

Market Growth Projections

The Global Integrated Bridge System for Ships Industry is projected to witness substantial growth over the next decade. With an expected market value of 5.86 USD Billion in 2024 and a forecasted increase to 9.43 USD Billion by 2035, the industry is poised for a compound annual growth rate of 4.42% from 2025 to 2035. This growth trajectory indicates a robust demand for integrated bridge systems, driven by technological advancements, regulatory compliance, and an increasing focus on safety and sustainability in maritime operations.

Sustainability Initiatives

The push for sustainability within the maritime sector is influencing the Global Integrated Bridge System for Ships Industry. Ship operators are increasingly adopting eco-friendly technologies to minimize their environmental footprint. Integrated bridge systems that optimize fuel consumption and reduce emissions are becoming essential in meeting sustainability goals. For instance, systems that provide real-time data on fuel efficiency can lead to significant cost savings and lower environmental impact. As the industry aligns with global sustainability initiatives, the market is poised for growth, reflecting a broader commitment to responsible maritime practices.

Technological Advancements

The Global Integrated Bridge System for Ships Industry is experiencing a surge in demand due to rapid technological advancements. Innovations such as automation, artificial intelligence, and enhanced navigation systems are transforming traditional bridge operations. These technologies not only improve safety but also enhance operational efficiency. For instance, the integration of AI in navigation aids allows for real-time data processing, which is crucial for decision-making. As a result, the market is projected to reach 5.86 USD Billion in 2024, reflecting a growing trend towards smarter, more efficient maritime operations.

Focus on Safety and Risk Management

Safety remains a paramount concern in the maritime industry, driving the Global Integrated Bridge System for Ships Industry. The integration of sophisticated bridge systems enhances situational awareness and risk management capabilities for ship operators. By utilizing advanced radar, sonar, and communication technologies, vessels can better navigate challenging conditions and avoid accidents. This focus on safety is not only a regulatory requirement but also a competitive advantage for shipping companies. As the industry prioritizes risk mitigation, the demand for integrated bridge systems is anticipated to grow significantly in the coming years.