Regulatory Support and Standardization

Regulatory support plays a crucial role in the growth of the autonomous ships Market. Governments and maritime organizations are increasingly recognizing the potential benefits of autonomous shipping, leading to the development of supportive regulations and standards. Initiatives aimed at establishing safety protocols and operational guidelines are being introduced, which may facilitate the adoption of autonomous technologies. For instance, the International Maritime Organization has been working on frameworks that could govern the use of autonomous vessels. This regulatory clarity is essential for fostering innovation and investment in the sector. As regulations evolve, they are likely to create a more conducive environment for the Autonomous Ships Market to flourish.

Cost Efficiency and Operational Savings

Cost efficiency is a primary driver in the Autonomous Ships Market, as companies seek to reduce operational expenses. Autonomous vessels can potentially lower labor costs, minimize fuel consumption, and enhance route optimization. Studies indicate that the implementation of autonomous technologies could lead to savings of up to 30% in operational costs. This financial incentive is particularly appealing to shipping companies facing rising costs and competitive pressures. Furthermore, the reduction in human error associated with autonomous operations can lead to fewer accidents and lower insurance premiums. As the industry continues to embrace automation, the financial benefits are likely to attract more stakeholders to invest in the Autonomous Ships Market.

Increased Demand for Maritime Automation

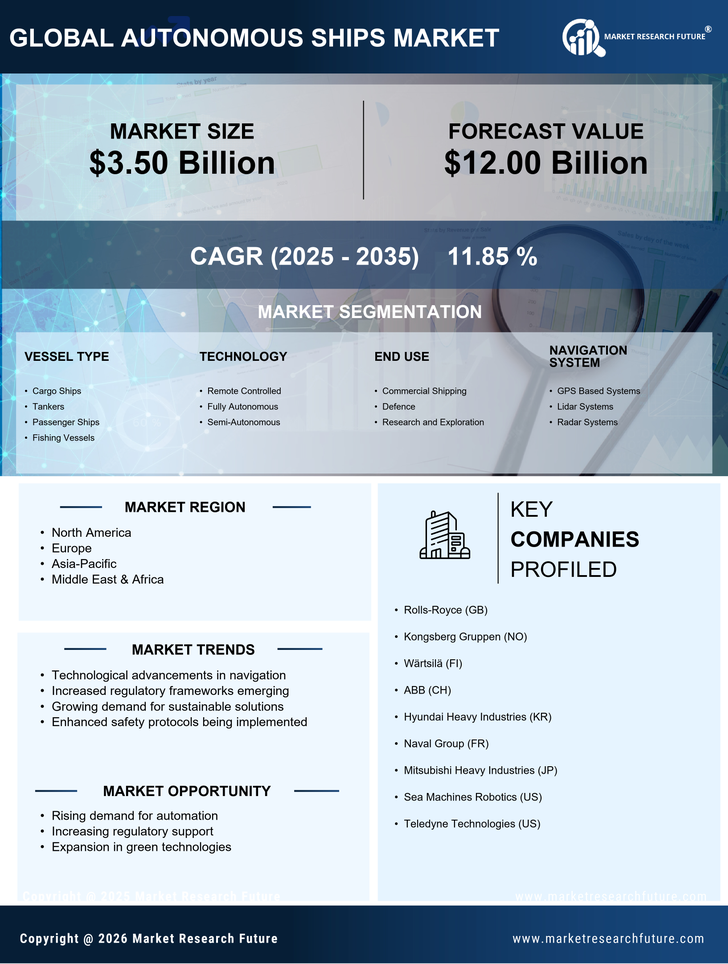

The demand for maritime automation is rapidly increasing, serving as a key driver for the Autonomous Ships Market. As shipping companies seek to enhance efficiency and reliability, the integration of autonomous technologies is becoming more prevalent. The rise in e-commerce and global trade has intensified the need for faster and more efficient shipping solutions. Market analyses indicate that the demand for automated shipping solutions could grow by over 15% annually in the coming years. This trend is likely to encourage more companies to explore autonomous options, thereby expanding the market landscape. As the industry adapts to these changing demands, the Autonomous Ships Market is poised for substantial growth.

Technological Innovations in Navigation Systems

The Autonomous Ships Market is experiencing a surge in technological innovations, particularly in navigation systems. Advanced sensors, artificial intelligence, and machine learning algorithms are being integrated into autonomous vessels, enhancing their ability to navigate complex maritime environments. These innovations are expected to reduce human error and improve operational efficiency. According to recent estimates, the market for autonomous navigation systems is projected to grow at a compound annual growth rate of over 20% through 2027. This growth is driven by the increasing demand for safer and more efficient shipping solutions, as well as the need for real-time data processing capabilities. As these technologies continue to evolve, they are likely to redefine operational standards within the Autonomous Ships Market.

Environmental Sustainability and Emission Reduction

The push for environmental sustainability is a significant driver in the Autonomous Ships Market. As the shipping sector faces increasing scrutiny over its environmental impact, autonomous vessels are being viewed as a solution to reduce emissions and enhance fuel efficiency. These ships can be designed to optimize fuel consumption and minimize waste, aligning with global sustainability goals. Reports suggest that the adoption of autonomous technologies could lead to a reduction in greenhouse gas emissions by up to 50% compared to traditional vessels. This potential for environmental improvement is likely to attract investment and support from both public and private sectors, further propelling the growth of the Autonomous Ships Market.