Growing Prevalence of HIV

The rising incidence of HIV infections is a primary driver for the Integrase Inhibitor Market. According to recent estimates, approximately 38 million people are living with HIV worldwide, with a significant proportion requiring antiretroviral therapy. Integrase inhibitors, known for their efficacy and safety profile, are increasingly being prescribed as part of treatment regimens. This growing patient population is likely to propel demand for integrase inhibitors, as healthcare providers seek effective solutions to manage HIV. Furthermore, the increasing awareness and testing initiatives contribute to early diagnosis, thereby expanding the treatment landscape. As the prevalence of HIV continues to rise, the Integrase Inhibitor Market is expected to experience substantial growth, driven by the need for innovative therapies that can improve patient outcomes.

Emerging Market Opportunities

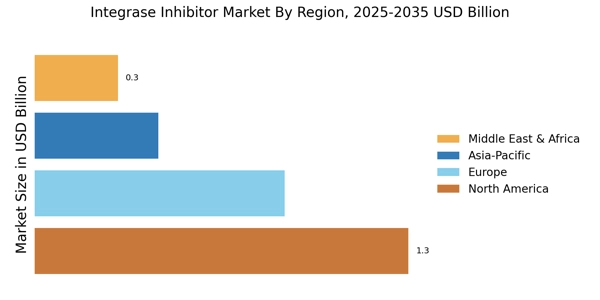

Emerging markets present substantial opportunities for the Integrase Inhibitor Market. As healthcare infrastructure improves in various regions, access to antiretroviral therapies, including integrase inhibitors, is becoming more feasible. Countries in Asia and Africa are witnessing a surge in demand for effective HIV treatments, driven by increasing healthcare investments and government initiatives aimed at combating the epidemic. The affordability of integrase inhibitors, coupled with the expansion of healthcare access, is likely to enhance market penetration in these regions. Pharmaceutical companies are recognizing the potential of these emerging markets and are strategically positioning themselves to capitalize on the growing demand. As these markets continue to develop, the Integrase Inhibitor Market is poised for significant growth, driven by the need for effective HIV treatment solutions.

Rising Awareness and Education

The growing awareness and education surrounding HIV and its treatment options are pivotal drivers for the Integrase Inhibitor Market. Public health campaigns and educational initiatives are effectively disseminating information about the importance of early diagnosis and treatment adherence. This heightened awareness is likely to lead to increased testing and, consequently, a larger patient population seeking integrase inhibitors as part of their treatment regimen. Furthermore, healthcare professionals are becoming more knowledgeable about the benefits of integrase inhibitors, which may influence prescribing patterns. As awareness continues to rise, the Integrase Inhibitor Market is expected to benefit from an influx of patients seeking effective therapies, thereby driving market growth.

Advancements in Drug Development

Innovations in drug development are significantly influencing the Integrase Inhibitor Market. Recent advancements in biotechnology and pharmaceutical research have led to the introduction of novel integrase inhibitors that demonstrate enhanced efficacy and reduced side effects. For instance, the development of long-acting formulations is gaining traction, potentially improving adherence among patients. The integration of artificial intelligence in drug discovery processes is also streamlining the identification of promising candidates, thereby accelerating the time to market. As these advancements continue to unfold, they are likely to attract investment and foster competition within the market, ultimately benefiting patients with more effective treatment options. The ongoing research and development efforts are expected to sustain the momentum of the Integrase Inhibitor Market, as new therapies emerge to meet the evolving needs of healthcare providers and patients.

Regulatory Support and Approvals

Regulatory bodies play a crucial role in shaping the Integrase Inhibitor Market through their support and approval processes. The expedited review pathways established by agencies such as the FDA and EMA facilitate quicker access to innovative therapies for patients. This regulatory environment encourages pharmaceutical companies to invest in the development of integrase inhibitors, knowing that there is a streamlined process for bringing their products to market. Additionally, the increasing number of approvals for new integrase inhibitors enhances the treatment landscape, providing healthcare providers with a broader array of options to tailor therapies to individual patient needs. As regulatory support continues to evolve, it is likely to foster a more dynamic and competitive Integrase Inhibitor Market, ultimately benefiting patients through improved access to cutting-edge treatments.