Integration of Advanced Technologies

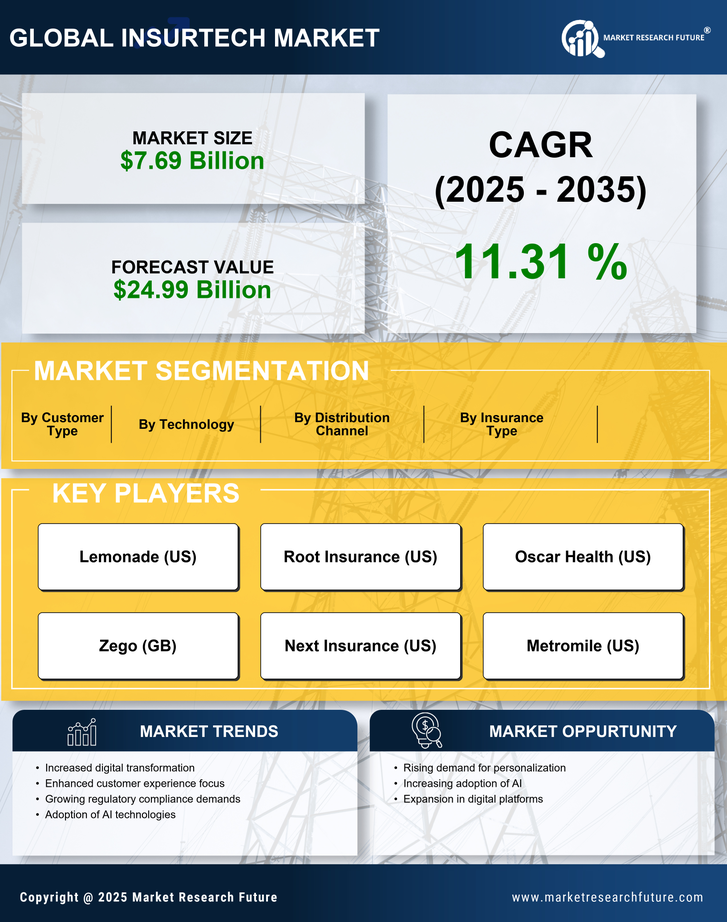

The InsurTech Market is significantly influenced by the integration of advanced technologies such as artificial intelligence, machine learning, and big data analytics. These technologies enable insurers to streamline operations, enhance risk assessment, and improve customer engagement. For instance, AI-driven chatbots are increasingly utilized for customer service, providing instant responses and reducing operational costs. Moreover, the use of predictive analytics allows insurers to better understand customer behavior and preferences, leading to more effective marketing strategies. According to recent data, companies that adopt these technologies report a 30% increase in operational efficiency. This technological integration not only enhances the customer experience but also positions InsurTech firms as agile competitors in a rapidly evolving market.

Increased Investment in InsurTech Startups

The InsurTech Market is witnessing a surge in investment, particularly in startups that offer innovative solutions. Venture capitalists and private equity firms are increasingly drawn to the potential of InsurTech, with investments reaching record levels in recent years. In 2025 alone, funding for InsurTech startups is projected to exceed 10 billion dollars, reflecting the growing confidence in the sector's future. This influx of capital enables startups to develop cutting-edge technologies and expand their market reach. Furthermore, established insurance companies are also investing in InsurTech firms to enhance their digital capabilities and stay competitive. This trend of increased investment is likely to accelerate innovation and drive growth within the InsurTech Market.

Shift Towards Digital Distribution Channels

The InsurTech Market is experiencing a pronounced shift towards digital distribution channels, as consumers increasingly prefer online platforms for purchasing insurance. This trend is driven by the convenience and accessibility that digital channels offer, allowing customers to compare policies and make informed decisions from the comfort of their homes. Recent statistics indicate that over 60% of insurance purchases are now initiated online, highlighting the importance of a strong digital presence for insurers. InsurTech companies are capitalizing on this shift by developing user-friendly platforms that facilitate seamless transactions and enhance customer engagement. As traditional insurers adapt to this digital landscape, the InsurTech Market is likely to see continued growth and transformation.

Regulatory Changes and Compliance Requirements

The InsurTech Market is currently navigating a complex landscape of regulatory changes and compliance requirements. Governments and regulatory bodies are increasingly focusing on consumer protection, data privacy, and cybersecurity, which directly impact how InsurTech companies operate. For instance, the implementation of stricter data protection laws necessitates that InsurTech firms invest in robust cybersecurity measures to safeguard customer information. This regulatory environment can be both a challenge and an opportunity; while compliance may increase operational costs, it also encourages innovation in developing secure and compliant solutions. As the industry adapts to these evolving regulations, companies that proactively embrace compliance are likely to gain a competitive edge in the InsurTech Market.

Rising Consumer Demand for Personalized Insurance Solutions

The InsurTech Market experiences a notable shift towards personalized insurance solutions, driven by changing consumer expectations. Customers increasingly seek tailored products that align with their unique needs and preferences. This trend is evidenced by a survey indicating that over 70% of consumers prefer insurance policies that can be customized. InsurTech companies are leveraging advanced data analytics and machine learning to create personalized offerings, enhancing customer satisfaction and retention. As a result, the industry is witnessing a surge in demand for innovative solutions that cater to individual requirements, thereby fostering competition among providers. This growing emphasis on personalization is likely to reshape the landscape of the InsurTech Market, compelling traditional insurers to adapt or risk obsolescence.