Cost Containment Initiatives

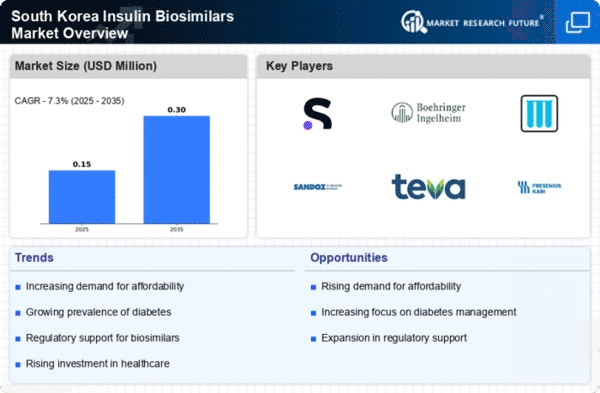

In South Korea, healthcare expenditure is a growing concern, prompting the government and healthcare providers to implement cost containment initiatives. These initiatives aim to reduce overall healthcare costs while maintaining quality care. The insulin biosimilars market is likely to thrive under these circumstances, as biosimilars typically offer lower prices compared to their reference biologics. This price advantage can lead to increased adoption among healthcare providers and patients, particularly in a landscape where affordability is paramount. Furthermore, the South Korean government has been actively promoting the use of biosimilars to enhance competition and drive down prices. As a result, the insulin biosimilars market is expected to expand, driven by the dual forces of cost containment and the need for effective diabetes management.

Increasing Prevalence of Diabetes

The rising incidence of diabetes in South Korea is a crucial driver for the insulin biosimilars market. According to recent health statistics, approximately 13.4% of the adult population is affected by diabetes, leading to a growing demand for effective treatment options. As the prevalence of diabetes continues to escalate, the need for affordable insulin therapies becomes more pronounced. Insulin biosimilars offer a cost-effective alternative to traditional insulin products, potentially reducing the financial burden on patients and healthcare systems. This trend is likely to stimulate market growth, as healthcare providers seek to manage diabetes more effectively while ensuring that patients have access to necessary medications. The insulin biosimilars market is thus positioned to benefit from this increasing prevalence, as it aligns with the urgent need for innovative and accessible treatment solutions.

Rising Patient Awareness and Education

Patient awareness and education regarding diabetes management and treatment options are on the rise in South Korea, which serves as a vital driver for the insulin biosimilars market. As patients become more informed about their treatment choices, they are increasingly seeking affordable alternatives to traditional insulin therapies. Educational campaigns and resources provided by healthcare organizations are empowering patients to engage in their treatment decisions actively. This heightened awareness is likely to lead to greater acceptance and utilization of insulin biosimilars, as patients recognize their potential benefits, including cost savings and similar efficacy to reference products. The insulin biosimilars market stands to gain from this trend, as informed patients advocate for more accessible and affordable treatment options.

Technological Advancements in Biologics

Technological advancements in the production and formulation of biologics are significantly influencing the insulin biosimilars market. Innovations in manufacturing processes, such as improved cell culture techniques and purification methods, have enhanced the quality and efficacy of biosimilars. In South Korea, these advancements are likely to lead to the development of more reliable and effective insulin biosimilars, which could attract both healthcare providers and patients. The ability to produce high-quality biosimilars at a lower cost may also encourage market entry for new players, fostering competition and further driving down prices. As the insulin biosimilars market evolves, these technological improvements are expected to play a pivotal role in shaping the landscape of diabetes treatment options available to patients.

Government Incentives for Biosimilar Adoption

The South Korean government has introduced various incentives to promote the adoption of biosimilars, which is a significant driver for the insulin biosimilars market. These incentives may include financial support for manufacturers, streamlined regulatory processes, and educational programs aimed at healthcare professionals. By fostering an environment conducive to biosimilar development and usage, the government aims to enhance patient access to affordable medications. This proactive approach is likely to result in increased market penetration of insulin biosimilars, as healthcare providers become more familiar with their benefits and efficacy. Consequently, the insulin biosimilars market is expected to experience growth as these government initiatives encourage a shift towards more cost-effective treatment options for diabetes.