Market Growth Projections

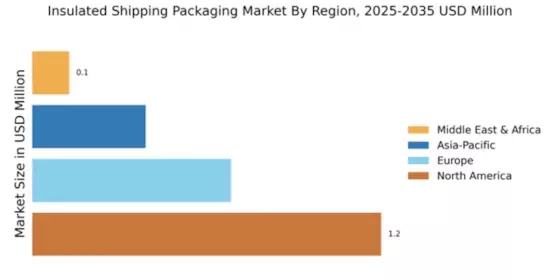

The Global Insulated Shipping Packaging Market Industry is poised for substantial growth, with projections indicating a market value of 1.48 USD Billion in 2024 and an anticipated increase to 3.47 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 8.04% from 2025 to 2035. Such figures underscore the increasing importance of insulated packaging solutions across various sectors, including pharmaceuticals, food, and e-commerce. The market's expansion reflects the ongoing need for effective temperature control during shipping, driven by evolving consumer preferences and regulatory requirements.

Regulatory Compliance and Safety Standards

Regulatory compliance plays a crucial role in shaping the Global Insulated Shipping Packaging Market Industry. Governments worldwide are implementing stringent regulations regarding the transportation of temperature-sensitive goods, particularly in the food and pharmaceutical sectors. Compliance with these regulations necessitates the use of high-quality insulated packaging solutions to ensure product safety and integrity during transit. Companies that fail to meet these standards risk facing penalties and product recalls, which can be detrimental to their reputation and financial standing. As a result, adherence to safety standards is driving the demand for insulated packaging solutions, further propelling market growth.

E-commerce Growth and Logistics Optimization

The rapid expansion of e-commerce is a pivotal driver for the Global Insulated Shipping Packaging Market Industry. As online shopping becomes more prevalent, the demand for efficient and reliable shipping solutions increases. Retailers are now focusing on optimizing their logistics to ensure that temperature-sensitive items are delivered in optimal condition. This shift is evidenced by the growth of companies specializing in insulated packaging solutions, which are adapting to meet the needs of e-commerce. The market is expected to grow at a CAGR of 8.04% from 2025 to 2035, reflecting the increasing importance of insulated packaging in the logistics chain.

Rising Demand for Temperature-Sensitive Products

The Global Insulated Shipping Packaging Market Industry experiences a surge in demand for temperature-sensitive products, particularly in the pharmaceutical and food sectors. As consumers increasingly seek fresh and safe products, companies are compelled to invest in insulated packaging solutions. For instance, the pharmaceutical industry alone is projected to grow significantly, necessitating advanced shipping methods to maintain product integrity. This trend is expected to contribute to the market's growth, with the market value anticipated to reach 1.48 USD Billion in 2024. The need for reliable insulated packaging solutions is thus becoming more pronounced, driving innovation and investment in this sector.

Technological Advancements in Packaging Materials

Technological advancements in packaging materials are significantly influencing the Global Insulated Shipping Packaging Market Industry. Innovations in insulation technology, such as the development of advanced foam materials and reflective barriers, enhance the thermal performance of packaging solutions. These advancements not only improve the efficiency of temperature control but also reduce the environmental impact of packaging materials. As sustainability becomes a priority for consumers and businesses alike, the demand for eco-friendly insulated packaging solutions is likely to increase. This trend is expected to contribute to the market's growth, with projections indicating a market value of 3.47 USD Billion by 2035.

Consumer Awareness and Preference for Sustainable Solutions

Consumer awareness regarding sustainability is increasingly impacting the Global Insulated Shipping Packaging Market Industry. As individuals become more conscious of their environmental footprint, there is a growing preference for sustainable packaging solutions. Companies are responding by developing insulated packaging that utilizes recyclable and biodegradable materials. This shift not only aligns with consumer values but also enhances brand reputation. The demand for sustainable insulated packaging is likely to drive innovation and investment in the sector, as businesses strive to meet consumer expectations while maintaining product integrity during shipping.