Growing Demand in Electronics

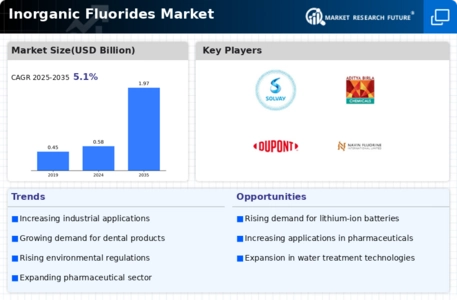

The Global Inorganic Fluorides Market Industry is experiencing a surge in demand driven by the electronics sector. Fluorides are essential in the production of semiconductors and other electronic components, which are increasingly utilized in various devices. As technology advances, the need for high-purity inorganic fluorides is likely to rise, contributing to market growth. In 2024, the market is projected to reach 0.58 USD Billion, reflecting the increasing integration of electronics in daily life. This trend indicates a robust trajectory for the industry as it adapts to the evolving technological landscape.

Rising Demand in Pharmaceuticals

The Global Inorganic Fluorides Market Industry is witnessing an uptick in demand from the pharmaceutical sector. Inorganic fluorides are utilized in the synthesis of various medicinal compounds, enhancing their efficacy and stability. As the global population ages and the need for innovative healthcare solutions grows, the pharmaceutical industry is likely to expand its use of these fluorides. This trend suggests a promising future for the market, with projections indicating a significant increase in demand, thereby reinforcing the industry's position in the broader chemical landscape.

Expansion in Chemical Manufacturing

The Global Inorganic Fluorides Market Industry is benefiting from the expansion of chemical manufacturing processes. Inorganic fluorides serve as critical intermediates in the synthesis of various chemicals, including fluoropolymers and agrochemicals. As industries seek to enhance production efficiency and develop innovative products, the demand for these fluorides is expected to rise. The market is projected to grow significantly, with estimates suggesting it could reach 1.97 USD Billion by 2035. This growth reflects the increasing reliance on inorganic fluorides in diverse applications, positioning the industry for sustained expansion.

Emerging Applications in Renewable Energy

The Global Inorganic Fluorides Market Industry is exploring emerging applications in the renewable energy sector. Inorganic fluorides are being investigated for their potential use in solar cells and energy storage systems, which are crucial for sustainable energy solutions. As the global focus shifts towards renewable energy sources, the demand for materials that enhance energy efficiency is likely to rise. This trend could contribute to the market's growth trajectory, with the industry poised to adapt to the evolving energy landscape.

Regulatory Support for Fluoride Applications

The Global Inorganic Fluorides Market Industry is likely to benefit from regulatory support aimed at promoting the safe use of fluorides in various applications. Governments worldwide are implementing guidelines that encourage the use of inorganic fluorides in sectors such as water treatment and dental care. This regulatory framework not only enhances consumer confidence but also stimulates market growth. As awareness of the benefits of fluoride increases, the industry may see a corresponding rise in demand, contributing to a projected CAGR of 11.79% from 2025 to 2035.