Emergence of 5G Technology

The Industrial SSD Market is on the cusp of transformation with the emergence of 5G technology. The rollout of 5G networks is expected to revolutionize data transmission speeds and connectivity, leading to increased data generation across various sectors. Industrial SSDs are well-positioned to meet the demands of this new era, offering the speed and reliability required for applications that rely on real-time data processing. As 5G technology continues to expand, the market for Industrial SSDs is likely to grow, driven by the need for efficient storage solutions that can handle the increased data flow. This trend indicates a promising future for Industrial SSDs in a 5G-enabled landscape.

Demand for Enhanced Data Security

In the current landscape, the Industrial SSD Market is witnessing a heightened focus on data security. With the increasing frequency of cyber threats, industries are prioritizing secure storage solutions to protect sensitive information. Industrial SSDs are designed with advanced security features, such as encryption and secure erase capabilities, making them a preferred choice for sectors that handle critical data. The Industrial SSD Market is projected to reach USD 345 billion by 2026, indicating a strong correlation between data security needs and the demand for secure storage solutions. This trend underscores the importance of Industrial SSDs in safeguarding data integrity and confidentiality.

Growth in Automation and Robotics

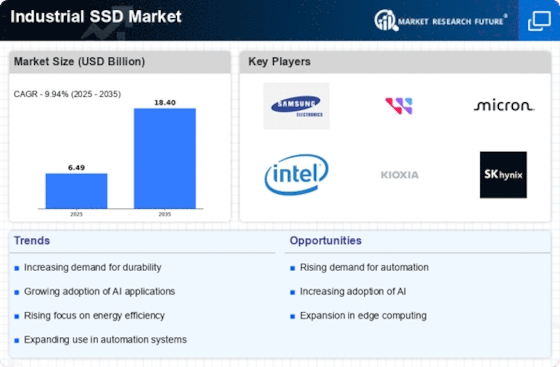

The Industrial SSD Market is poised for growth due to the rising trend of automation and robotics across various sectors. Industries are increasingly adopting automated systems to enhance productivity and reduce operational costs. Industrial SSDs are essential in these systems, providing the necessary speed and durability to support real-time data processing. The market for industrial automation is expected to grow at a compound annual growth rate (CAGR) of approximately 9% over the next five years. This growth suggests that as more industries implement automated solutions, the demand for Industrial SSDs will likely increase, further solidifying their importance in modern industrial applications.

Increasing Adoption of IoT Devices

The Industrial SSD Market is experiencing a notable surge in the adoption of Internet of Things (IoT) devices. As industries increasingly integrate IoT solutions for enhanced operational efficiency, the demand for high-performance storage solutions becomes critical. Industrial SSDs offer the speed and reliability necessary to handle the vast amounts of data generated by IoT devices. According to recent estimates, the number of connected IoT devices is projected to reach 30 billion by 2030, which could significantly drive the need for robust storage solutions. This trend indicates a shift towards more data-centric operations, where Industrial SSDs play a pivotal role in ensuring seamless data processing and storage capabilities.

Shift Towards High-Performance Computing

The Industrial SSD Market is benefiting from the ongoing shift towards high-performance computing (HPC) solutions. As industries seek to process large datasets more efficiently, the need for high-speed storage solutions becomes paramount. Industrial SSDs provide the necessary performance enhancements to support HPC applications, enabling faster data access and processing times. The HPC market is anticipated to grow significantly, with projections indicating a CAGR of around 7% over the next few years. This growth suggests that as industries increasingly rely on HPC for data-intensive tasks, the demand for Industrial SSDs will likely rise, reinforcing their critical role in modern computing environments.