Technological Advancements in SSDs

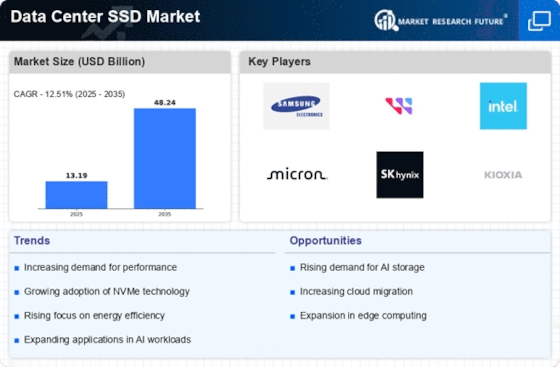

Technological advancements in SSD technology are a crucial driver for the Data Center SSD Market. Innovations such as 3D NAND technology and NVMe interfaces have significantly improved the performance and efficiency of SSDs. These advancements allow for higher storage capacities and faster data transfer rates, making SSDs more appealing for data center applications. The introduction of PCIe 4.0 and the anticipated PCIe 5.0 standards are expected to further enhance SSD performance, potentially doubling data transfer speeds. As data centers seek to optimize their operations and reduce latency, the adoption of these advanced SSD technologies is likely to accelerate, thereby propelling the Data Center SSD Market.

Adoption of Cloud Computing Services

The rapid adoption of cloud computing services is significantly influencing the Data Center SSD Market. As businesses migrate to cloud-based solutions, the demand for high-performance storage systems has surged. Cloud service providers are increasingly investing in SSD technology to enhance their service offerings, ensuring faster data retrieval and improved user experiences. Reports indicate that the cloud computing market is projected to grow to over 800 billion dollars by 2025, which directly correlates with the rising demand for SSDs in data centers. This trend underscores the critical role of SSDs in supporting the infrastructure of cloud services, thereby driving growth in the Data Center SSD Market.

Increasing Data Volume and Complexity

The exponential growth of data generated by enterprises is a primary driver for the Data Center SSD Market. As organizations increasingly rely on data analytics, machine learning, and artificial intelligence, the volume and complexity of data continue to rise. According to recent estimates, data creation is expected to reach 175 zettabytes by 2025. This surge necessitates advanced storage solutions that can handle large datasets efficiently. SSDs, with their superior speed and reliability, are becoming the preferred choice for data centers. The need for quick access to vast amounts of data is pushing data centers to adopt SSDs over traditional hard drives, thereby propelling the Data Center SSD Market forward.

Cost Reduction and Performance Optimization

The need for cost reduction and performance optimization is a significant driver for the Data Center SSD Market. As data centers strive to enhance operational efficiency, the shift from traditional hard drives to SSDs is becoming more pronounced. SSDs, while initially more expensive, offer lower total cost of ownership due to their durability, energy efficiency, and reduced maintenance costs. The performance benefits of SSDs, including faster boot times and quicker data access, contribute to overall productivity improvements. As organizations seek to balance performance with cost, the transition to SSDs is likely to continue, further propelling the Data Center SSD Market.

Growing Focus on Data Security and Compliance

The increasing emphasis on data security and regulatory compliance is driving the Data Center SSD Market. Organizations are becoming more aware of the risks associated with data breaches and are investing in secure storage solutions. SSDs offer enhanced security features, such as encryption and secure erase capabilities, which are essential for protecting sensitive information. With regulations like GDPR and CCPA imposing strict data protection requirements, businesses are compelled to adopt storage solutions that ensure compliance. This trend is likely to boost the demand for SSDs in data centers, as organizations prioritize security in their storage strategies, thereby influencing the Data Center SSD Market.