Technological Advancements

The Global Industrial Sensor Market Industry is experiencing a surge in technological advancements, particularly in sensor technologies such as IoT and AI integration. These innovations enhance the capabilities of sensors, allowing for real-time data collection and analysis. For instance, smart sensors are increasingly utilized in manufacturing processes, leading to improved efficiency and reduced operational costs. As industries adopt these advanced technologies, the market is projected to reach 25.9 USD Billion in 2024, indicating a robust growth trajectory. This trend suggests that companies investing in cutting-edge sensor technologies are likely to gain a competitive edge in the Global Industrial Sensor Market.

Rising Demand for Automation

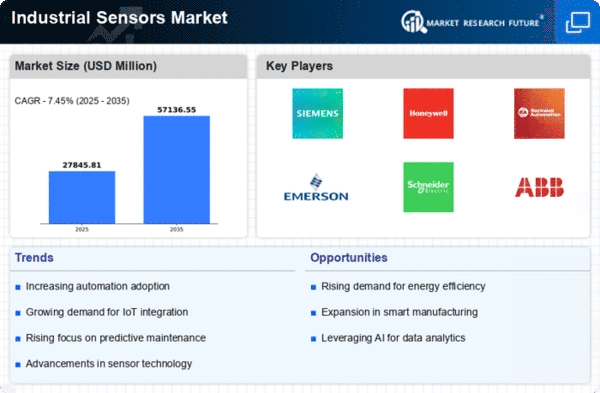

The Global Industrial Sensor Market Industry is driven by the increasing demand for automation across various sectors, including manufacturing, oil and gas, and automotive. Automation enhances productivity and operational efficiency, leading to a greater reliance on industrial sensors for monitoring and control. For example, in the automotive industry, sensors are essential for advanced driver-assistance systems, which are becoming standard in modern vehicles. This growing trend towards automation is expected to contribute to the market's expansion, with projections indicating a market size of 57.1 USD Billion by 2035. Consequently, the demand for industrial sensors is likely to rise significantly as industries seek to automate processes.

Growth in Smart Manufacturing

The Global Industrial Sensor Market Industry is significantly impacted by the growth of smart manufacturing practices, which leverage advanced technologies to optimize production processes. Smart factories utilize interconnected sensors to gather data and facilitate real-time decision-making, enhancing overall operational efficiency. For example, predictive maintenance enabled by sensors can reduce downtime and maintenance costs. This trend is indicative of a broader shift towards Industry 4.0, where automation and data exchange are paramount. As smart manufacturing continues to gain traction, the market is anticipated to grow at a CAGR of 7.45% from 2025 to 2035, reflecting the increasing reliance on industrial sensors in modern manufacturing environments.

Focus on Safety and Compliance

The Global Industrial Sensor Market Industry is increasingly influenced by the heightened focus on safety and regulatory compliance across various sectors. Industries are mandated to adhere to stringent safety standards, necessitating the use of sensors for monitoring environmental conditions and equipment performance. For instance, in the chemical manufacturing sector, sensors play a critical role in detecting hazardous leaks and ensuring compliance with safety regulations. This emphasis on safety is driving the adoption of advanced sensor technologies, thereby propelling market growth. As companies prioritize safety measures, the demand for industrial sensors is expected to rise, further solidifying their importance in the Global Industrial Sensor Market.

Environmental Sustainability Initiatives

The Global Industrial Sensor Market Industry is also influenced by the growing emphasis on environmental sustainability initiatives. Companies are increasingly adopting sensors to monitor emissions and energy consumption, aligning with global efforts to reduce carbon footprints. For instance, sensors are utilized in renewable energy sectors to optimize energy production and minimize waste. This trend not only supports regulatory compliance but also enhances corporate social responsibility. As industries strive for sustainability, the demand for industrial sensors is expected to rise, contributing to the overall growth of the market. The integration of sensors in sustainability efforts underscores their critical role in the Global Industrial Sensor Market.