Growth in Industrial Manufacturing

The growth in industrial manufacturing is a pivotal factor driving the Industrial Rubber Product Market. As manufacturing processes become more sophisticated, the need for durable and high-quality rubber components is escalating. Industries such as aerospace, electronics, and machinery are increasingly utilizing rubber products for seals, gaskets, and insulation. In 2025, the manufacturing sector is projected to expand at a rate of 3.8%, which will likely lead to a corresponding increase in the demand for industrial rubber products. This trend suggests that the Industrial Rubber Product Market is poised for growth as manufacturers seek reliable materials to enhance product performance.

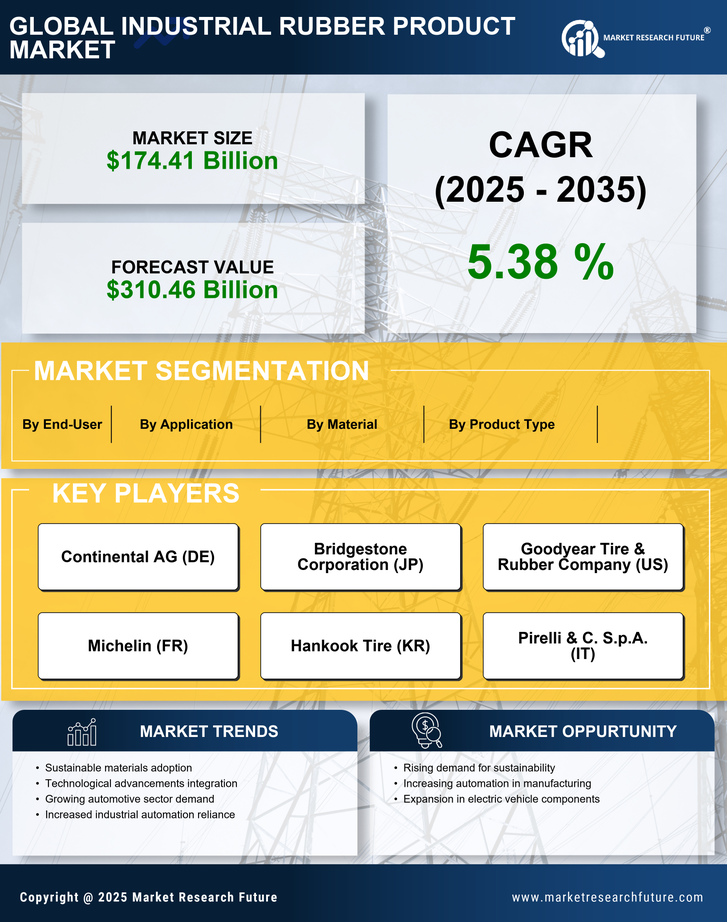

Rising Demand from Automotive Sector

The automotive sector is a primary driver for the Industrial Rubber Product Market, as it increasingly relies on rubber components for various applications. The demand for tires, seals, and gaskets is projected to grow, driven by the expansion of electric vehicles and advancements in automotive technology. In 2025, the automotive industry is expected to account for a substantial share of the rubber market, with estimates suggesting a growth rate of approximately 4.5% annually. This trend indicates a robust need for high-performance rubber products that meet stringent safety and environmental standards, thereby propelling the Industrial Rubber Product Market forward.

Infrastructure Development Initiatives

Infrastructure development initiatives are significantly influencing the Industrial Rubber Product Market. Governments and private entities are investing heavily in infrastructure projects, including roads, bridges, and public transportation systems. This surge in construction activities is likely to increase the demand for rubber products used in construction applications, such as expansion joints and vibration dampers. Recent data indicates that the construction sector is expected to grow at a rate of 5% annually, which will likely enhance the consumption of industrial rubber products. Consequently, this trend underscores the critical role of the Industrial Rubber Product Market in supporting infrastructure growth.

Environmental Regulations and Compliance

Environmental regulations and compliance requirements are shaping the Industrial Rubber Product Market. As industries face increasing scrutiny regarding their environmental impact, there is a growing demand for sustainable rubber products. Manufacturers are compelled to adopt eco-friendly practices and materials, which may include the use of recycled rubber and bio-based alternatives. In 2025, it is anticipated that the market for sustainable rubber products will grow by approximately 6%, reflecting a shift towards environmentally responsible manufacturing. This trend indicates that the Industrial Rubber Product Market must adapt to evolving regulations and consumer preferences for sustainable solutions.

Technological Innovations in Rubber Processing

Technological innovations in rubber processing are transforming the Industrial Rubber Product Market. Advances in manufacturing techniques, such as 3D printing and automation, are enhancing the efficiency and precision of rubber product production. These innovations enable manufacturers to create customized solutions that meet specific client needs, thereby expanding market opportunities. In 2025, it is expected that the adoption of advanced processing technologies will increase by 7%, indicating a significant shift in production capabilities. This trend suggests that the Industrial Rubber Product Market is likely to experience enhanced competitiveness and growth as technology continues to evolve.