Growth in Consumer Goods Sector

The consumer goods sector is emerging as a significant driver for the Industrial Rubber Market. With the rise in disposable income and changing consumer preferences, there is an increasing demand for rubber products in household items, appliances, and personal care products. In 2025, it is estimated that the consumer goods sector will represent approximately 20% of the total rubber market, reflecting a shift towards more sustainable and innovative materials. This growth suggests that manufacturers in the Industrial Rubber Market will need to adapt to evolving consumer trends, focusing on quality and sustainability to capture market share.

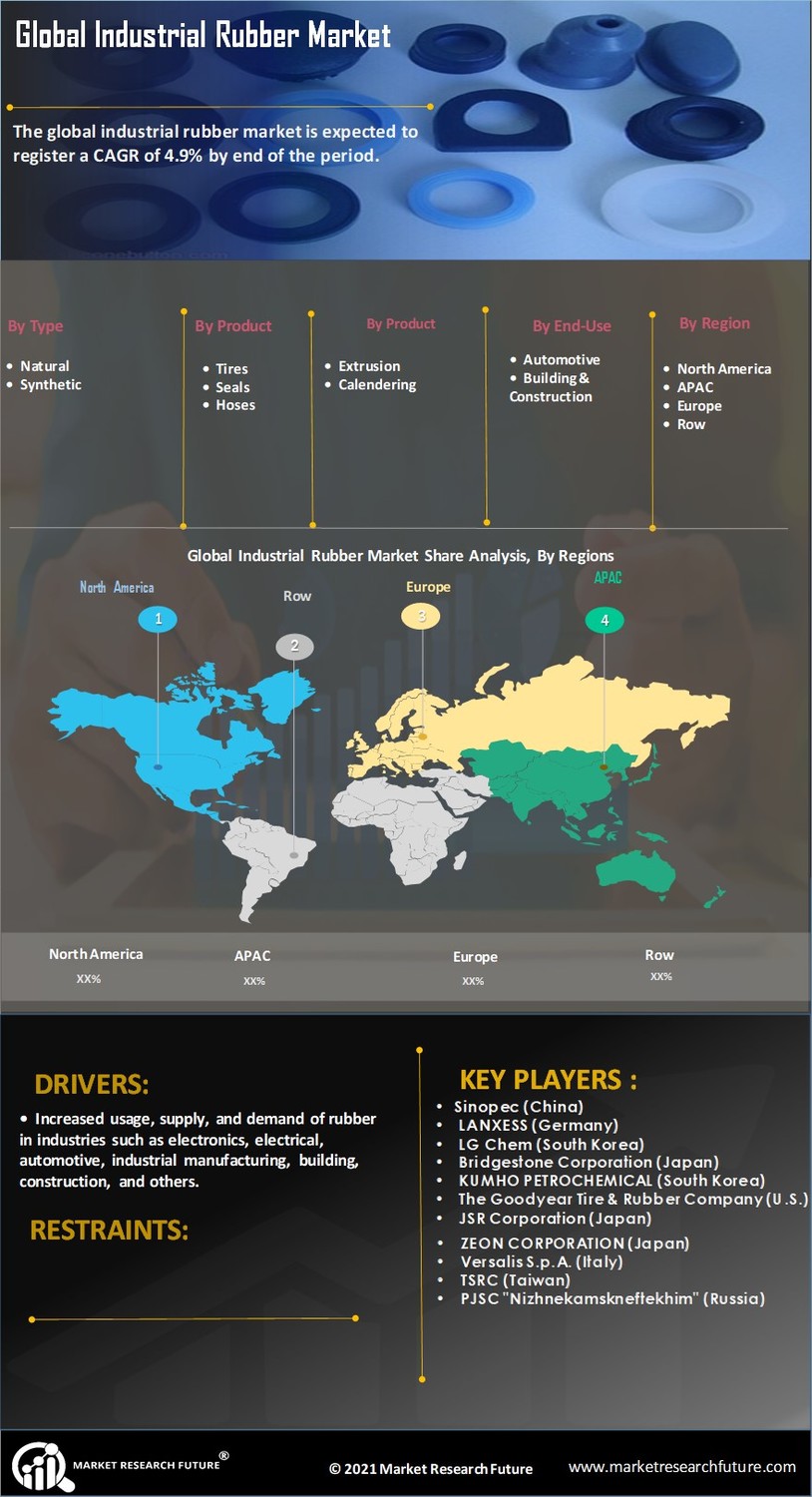

Rising Demand from Automotive Sector

The automotive sector plays a pivotal role in driving the Industrial Rubber Market. As vehicle production continues to rise, the demand for rubber components such as tires, seals, and gaskets increases correspondingly. In 2025, the automotive industry is projected to consume approximately 30% of the total rubber production, highlighting the sector's significance. Furthermore, the shift towards electric vehicles is likely to enhance the demand for specialized rubber products, as these vehicles require advanced materials for insulation and durability. This trend suggests that the Industrial Rubber Market will experience substantial growth, fueled by innovations in automotive design and manufacturing processes.

Infrastructure Development Initiatives

Infrastructure development initiatives are significantly influencing the Industrial Rubber Market. Governments and private entities are investing heavily in infrastructure projects, including roads, bridges, and railways. This investment is expected to create a robust demand for rubber products used in construction and maintenance, such as expansion joints and waterproofing membranes. In 2025, the construction sector is anticipated to account for around 25% of the total rubber consumption, indicating a strong correlation between infrastructure growth and rubber demand. The Industrial Rubber Market is likely to benefit from these developments, as the need for durable and high-performance materials becomes increasingly critical.

Environmental Regulations and Compliance

Environmental regulations and compliance are increasingly influencing the Industrial Rubber Market. Stricter regulations regarding waste management and emissions are prompting manufacturers to adopt more sustainable practices. This shift is likely to drive demand for eco-friendly rubber products, such as those made from recycled materials or bio-based alternatives. In 2025, it is anticipated that the market for sustainable rubber products will grow by 10%, reflecting a broader trend towards environmental responsibility. As companies strive to meet regulatory requirements, the Industrial Rubber Market may witness a transformation in product offerings, aligning with consumer expectations for sustainability.

Technological Innovations in Manufacturing

Technological innovations in manufacturing processes are reshaping the Industrial Rubber Market. Advancements such as automation, 3D printing, and improved compounding techniques are enhancing production efficiency and product quality. These innovations allow manufacturers to create specialized rubber products that meet specific industry requirements, thereby expanding their market reach. In 2025, it is projected that companies adopting advanced manufacturing technologies will see a 15% increase in productivity, which could lead to a more competitive landscape within the Industrial Rubber Market. This trend indicates a potential for growth driven by efficiency and customization.