North America : Market Leader in MRO Services

North America continues to lead the Industrial Pressure Testing Equipment MRO Services Market, holding a significant market share of 1.6 in 2024. The region's growth is driven by robust demand from the oil and gas sector, stringent safety regulations, and technological advancements in pressure testing equipment. The increasing focus on operational efficiency and safety compliance further propels market expansion.

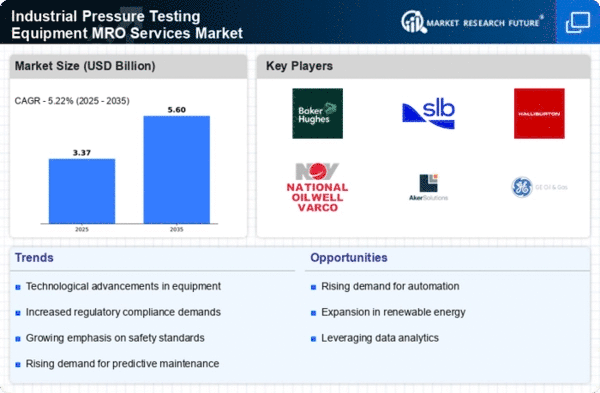

The competitive landscape is characterized by the presence of major players such as Baker Hughes, Schlumberger, and Halliburton, which dominate the market. The U.S. remains the leading country, supported by a well-established infrastructure and investment in energy projects. The ongoing shift towards automation and digitalization in MRO services is expected to enhance service delivery and operational efficiency.

Europe : Emerging Market with Growth Potential

Europe's Industrial Pressure Testing Equipment MRO Services Market is valued at 0.9, reflecting a growing demand driven by regulatory frameworks aimed at enhancing safety and environmental standards. The European Union's commitment to energy efficiency and sustainability is a key catalyst for market growth. Additionally, the increasing investments in renewable energy projects are expected to further stimulate demand for pressure testing services.

Leading countries in this region include Germany, the UK, and France, where major players like Aker Solutions and GE Oil & Gas are actively expanding their operations. The competitive landscape is evolving, with a focus on innovation and compliance with stringent regulations. The presence of established companies and a growing number of startups contribute to a dynamic market environment.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region, with a market size of 0.7, is witnessing rapid growth in the Industrial Pressure Testing Equipment MRO Services Market. This growth is fueled by increasing industrialization, urbanization, and the expansion of the oil and gas sector. Countries like China and India are investing heavily in infrastructure and energy projects, driving demand for reliable pressure testing services. Regulatory support for safety standards is also a significant growth driver in this region.

China and India are the leading countries in this market, with a competitive landscape featuring both local and international players. Companies like Weatherford International and FMC Technologies are expanding their footprint in the region. The market is characterized by a mix of established firms and emerging players, fostering innovation and competitive pricing strategies to meet the growing demand.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region currently holds a market size of 0.0 in the Industrial Pressure Testing Equipment MRO Services Market, indicating significant untapped potential. The region faces challenges such as political instability and limited infrastructure, which hinder market growth. However, the increasing focus on oil and gas exploration and production activities presents opportunities for future development. Regulatory frameworks are gradually evolving to support safety and operational standards in the industry.

Countries like Saudi Arabia and the UAE are leading the way in market development, with investments in energy projects and infrastructure. The competitive landscape is still emerging, with a few key players beginning to establish a presence. As the region stabilizes and invests in infrastructure, the demand for pressure testing services is expected to grow, attracting more players to the market.