Regulatory Compliance

Regulatory compliance remains a critical driver for the Industrial Metrology Market. As industries face increasing scrutiny regarding product quality and safety, adherence to stringent regulations becomes paramount. For example, sectors such as pharmaceuticals and food processing are mandated to comply with specific measurement standards to ensure product integrity. The need for precise measurement tools to meet these regulations is likely to propel the demand for metrology solutions. Recent statistics suggest that the compliance-related expenditures in these sectors could reach approximately 15% of total operational costs, highlighting the importance of reliable metrology in maintaining compliance and enhancing operational efficiency within the Industrial Metrology Market.

Technological Advancements

The Industrial Metrology Market is experiencing a surge in technological advancements, particularly in automation and digitalization. The integration of advanced sensors, artificial intelligence, and machine learning is enhancing measurement accuracy and efficiency. For instance, the adoption of 3D scanning technologies is revolutionizing quality control processes across various sectors, including automotive and aerospace. According to recent data, the market for automated measurement systems is projected to grow at a compound annual growth rate of 8.5% from 2025 to 2030. This trend indicates a strong demand for innovative metrology solutions that can meet the evolving needs of industries, thereby driving growth in the Industrial Metrology Market.

Rising Demand for Quality Assurance

The rising demand for quality assurance across various industries is a significant driver for the Industrial Metrology Market. As competition intensifies, manufacturers are increasingly focusing on delivering high-quality products to maintain market share. This trend is particularly evident in sectors such as electronics and medical devices, where precision and reliability are non-negotiable. The global market for quality assurance services is expected to expand at a rate of 7% annually, reflecting the growing emphasis on quality control measures. Consequently, the demand for advanced metrology solutions that facilitate rigorous testing and validation processes is likely to increase, further propelling the growth of the Industrial Metrology Market.

Emerging Markets and Industrialization

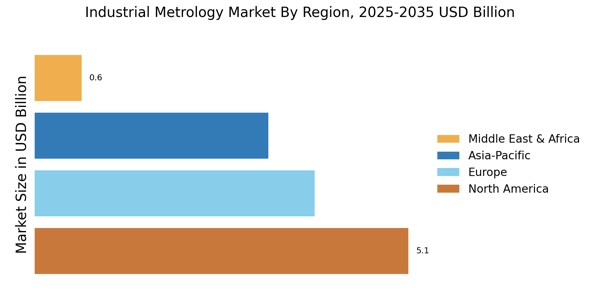

Emerging markets are witnessing rapid industrialization, which serves as a catalyst for the Industrial Metrology Market. Countries in Asia and Africa are investing heavily in manufacturing and infrastructure development, leading to an increased need for precise measurement tools. The expansion of industries such as construction, automotive, and electronics in these regions is driving the demand for metrology solutions. Recent projections indicate that the industrial sector in these emerging economies could grow by over 10% annually, creating substantial opportunities for metrology providers. This trend underscores the potential for growth within the Industrial Metrology Market as these markets continue to evolve and expand.

Increased Focus on Research and Development

An increased focus on research and development (R&D) within various industries is significantly influencing the Industrial Metrology Market. Companies are allocating more resources to R&D to innovate and improve product offerings, which necessitates precise measurement and testing capabilities. The aerospace and defense sectors, in particular, are investing heavily in R&D to develop advanced technologies, thereby driving the demand for sophisticated metrology solutions. Data indicates that R&D expenditures in these sectors could reach upwards of 20% of total revenue, emphasizing the critical role of metrology in supporting innovation. This trend is likely to foster growth in the Industrial Metrology Market as organizations seek to enhance their competitive edge through superior measurement capabilities.