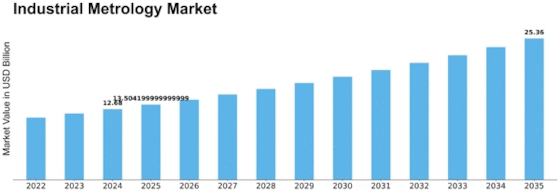

Industrial Metrology Size

Industrial Metrology Market Growth Projections and Opportunities

The Industrial Metrology Market is molded by a huge number of variables that on the whole impact its development and direction. One of the essential market factors is the rising accentuation on quality control across businesses. As assembling processes become more unpredictable, the requirement for exact estimations to guarantee item quality has become central. Modern metrology arrangements, going from CMMs to optical estimation frameworks, assume a vital part in fulfilling these quality guidelines, driving their reception across different areas, for example, auto, aviation, and hardware.

The ceaseless advancement of assembling processes is another key component affecting the industrial metrology market. The need for similarly sophisticated measurement technologies grows as industries move toward advanced manufacturing methods like additive manufacturing and precision machining. Makers look for metrology arrangements that can precisely survey the unpredictable subtleties of parts created through these high-level techniques, mirroring the powerful idea of the market.

Standardized metrology solutions are in high demand as a result of globalization. With assembling tasks scattered worldwide, enterprises face the test of guaranteeing consistency in item quality across various areas. Modern metrology tends to this test by giving normalized estimation strategies and advances, working with consistent joint effort in a globalized producing scene.

Cost contemplations are critical market factors impacting the reception of industrial metrology arrangements. While enterprises perceive the significance of accuracy in assembling, they additionally look for savvy metrology arrangements. This request has prodded advancement on the lookout, prompting the improvement of more reasonable and proficient estimation innovations. The objective is to find some kind of harmony among accuracy and cost-viability, making metrology open to a more extensive scope of ventures.

Administrative consistency is a huge driver for the industrial metrology market, especially in ventures where adherence to severe quality and security guidelines is required. Metrology solutions are used by industries like healthcare, aerospace, and automotive to meet regulatory requirements and guarantee that their products meet the highest quality and safety standards. This administrative scene spurs a reliable interest for cutting edge metrology advances in these areas.

Mechanical progressions assume a focal part in molding the industrial metrology market. The constant improvement of estimation innovations, including 3D checking, laser-based frameworks, and high-level imaging strategies, upgrades the abilities of metrology arrangements. These innovative progressions work on the exactness of estimations as well as add to quicker and more proficient examination processes, further powering the reception of industrial metrology arrangements.

Market rivalry is a main impetus for development inside the industrial metrology area. The market's businesses compete with one another by providing distinctive features, enhanced software capabilities, and user-friendly interfaces. This serious scene cultivates a consistent drive for development, guaranteeing that market players stay at the cutting edge of innovative headways to meet the advancing requirements of enterprises.

The more extensive financial climate likewise impacts the industrial metrology market. Monetary variances and vulnerabilities can influence venture choices inside enterprises, influencing their eagerness to embrace new metrology advances. Nonetheless, the flexibility of the assembling area, combined with the continuous requirement for accuracy underway cycles, gives an establishment to showcase strength even in testing monetary circumstances.

Leave a Comment