North America : Market Leader in Innovation

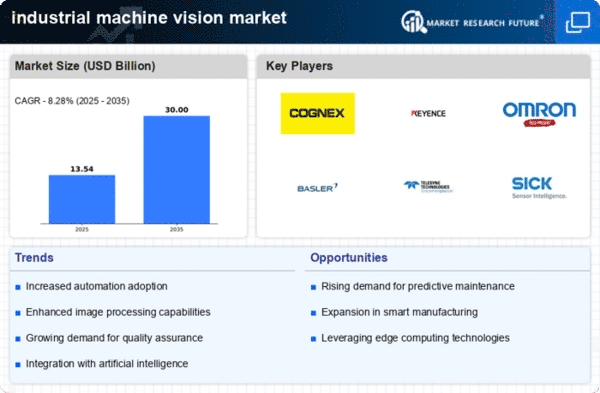

North America continues to lead the industrial machine vision market, holding a significant share of 5.0 in 2024. The region's growth is driven by advancements in automation, increased demand for quality control, and the integration of AI technologies. Regulatory support for manufacturing and technology innovation further catalyzes market expansion, making it a hub for cutting-edge solutions. The competitive landscape is robust, with key players like Cognex Corporation, Teledyne Technologies, and National Instruments Corporation dominating the market. The U.S. remains the largest contributor, supported by a strong manufacturing base and investment in R&D. This environment fosters innovation, ensuring that North America retains its leadership position in The industrial machine vision market.

Europe : Emerging Technology Adoption

Europe's industrial machine vision market is poised for growth, with a market size of 3.5 in 2024. The region is experiencing a surge in demand due to the adoption of Industry 4.0 practices, which emphasize automation and data exchange in manufacturing technologies. Regulatory frameworks promoting sustainability and efficiency are also key drivers, encouraging investments in advanced machine vision systems. Leading countries such as Germany and the UK are at the forefront, with companies like Basler AG and SICK AG playing pivotal roles. The competitive landscape is characterized by a mix of established firms and innovative startups, all vying to capture market share in this rapidly evolving sector. The European market is expected to continue its upward trajectory as technology adoption accelerates.

Asia-Pacific : Rapid Growth and Expansion

The Asia-Pacific region is witnessing rapid growth in the industrial machine vision market, with a size of 3.0 in 2024. Key drivers include increasing industrial automation, rising labor costs, and a growing focus on quality assurance. Countries like Japan and China are leading this growth, supported by government initiatives aimed at enhancing manufacturing capabilities and technological advancements. The competitive landscape features major players such as Keyence Corporation and Omron Corporation, which are leveraging their technological expertise to capture market share. The region's diverse industrial base, coupled with a strong emphasis on innovation, positions Asia-Pacific as a formidable player in The industrial machine vision market, with significant potential for future expansion.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging in the industrial machine vision market, with a market size of 1.0 in 2024. Growth is driven by increasing investments in manufacturing and infrastructure, alongside a rising demand for automation solutions. Regulatory initiatives aimed at enhancing industrial efficiency are also contributing to market development, creating a conducive environment for machine vision technologies. Countries like South Africa and the UAE are leading the charge, with a growing number of local and international players entering the market. The competitive landscape is evolving, with companies seeking to establish a foothold in this promising region. As investments continue to flow, the Middle East and Africa are expected to see significant advancements in industrial machine vision applications.