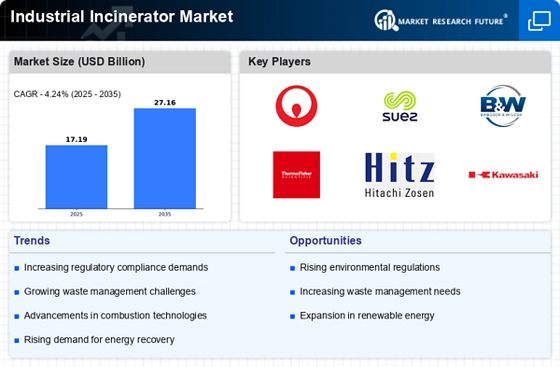

Rising Energy Demand

The Industrial Incinerator Market is also driven by the rising demand for energy, particularly renewable energy sources. As traditional energy resources become scarcer and more expensive, industries are exploring alternative energy solutions. Incineration offers a dual benefit by providing waste disposal and generating energy from waste materials. The potential to convert waste into energy aligns with global efforts to transition towards sustainable energy practices. Reports indicate that the energy recovery from waste incineration could contribute significantly to the energy mix, potentially supplying up to 15% of the total energy demand in certain regions. This growing energy demand, coupled with the need for effective waste management, positions the Industrial Incinerator Market as a critical player in the energy landscape.

Technological Innovations

Technological advancements play a pivotal role in shaping the Industrial Incinerator Market. Innovations in incineration technology, such as improved combustion processes and emission control systems, enhance the efficiency and effectiveness of waste treatment. For example, the integration of advanced monitoring systems allows for real-time tracking of emissions, ensuring compliance with environmental standards. Furthermore, the development of energy recovery systems enables the conversion of waste into usable energy, thus adding value to the incineration process. As industries increasingly seek efficient waste management solutions, the adoption of these technologies is likely to drive growth in the Industrial Incinerator Market. The continuous evolution of incineration technology suggests a promising future for this sector.

Increasing Waste Generation

The Industrial Incinerator Market is experiencing a notable surge in demand due to the increasing generation of waste across various sectors. As urbanization and industrial activities expand, the volume of waste produced is projected to rise significantly. According to recent estimates, waste generation is expected to reach approximately 3.4 billion tons annually by 2025. This escalating waste crisis necessitates efficient disposal methods, with incineration emerging as a viable solution. Incinerators not only reduce waste volume but also convert waste into energy, thereby addressing both disposal and energy needs. Consequently, the growing waste generation is a primary driver for the Industrial Incinerator Market, compelling industries to invest in advanced incineration technologies to manage waste sustainably.

Stringent Environmental Regulations

The Industrial Incinerator Market is significantly influenced by stringent environmental regulations aimed at reducing pollution and promoting sustainable waste management practices. Governments worldwide are implementing rigorous standards to control emissions from waste disposal methods. For instance, regulations such as the European Union's Waste Framework Directive mandate the reduction of landfill use and encourage waste-to-energy solutions. These regulations compel industries to adopt incineration technologies that comply with emission standards, thereby driving the demand for advanced incinerators. The market is projected to grow as companies seek to align with these regulations, ensuring compliance while minimizing their environmental footprint. This regulatory landscape is a crucial factor propelling the Industrial Incinerator Market forward.

Diversification of Industrial Applications

The Industrial Incinerator Market is witnessing diversification in applications across various sectors, including healthcare, manufacturing, and municipal waste management. As industries recognize the importance of effective waste disposal methods, incineration is increasingly being adopted for a wide range of waste types, including hazardous and non-hazardous materials. This diversification is driven by the need for specialized waste management solutions that cater to specific industry requirements. For instance, the healthcare sector generates a substantial amount of biomedical waste, necessitating efficient disposal methods to mitigate health risks. The adaptability of incineration technologies to different waste streams enhances their appeal, thereby driving growth in the Industrial Incinerator Market. This trend indicates a broader acceptance of incineration as a reliable waste management solution.