Growth of the Biofuel Sector

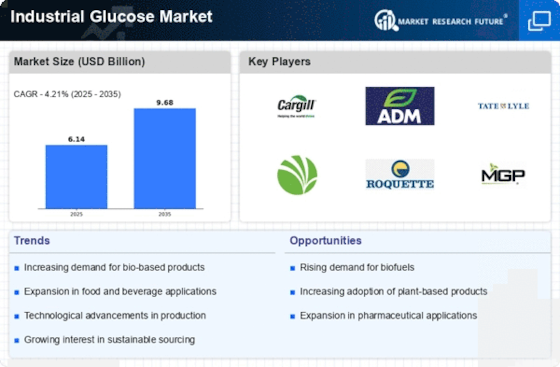

The Industrial Glucose Market is also influenced by the growth of the biofuel sector, where glucose serves as a vital feedstock for bioethanol production. As countries strive to reduce carbon emissions and transition to renewable energy sources, the demand for biofuels is on the rise. Industrial glucose is increasingly being utilized in the fermentation process to produce bioethanol, which is a cleaner alternative to fossil fuels. Recent projections indicate that the biofuel industry could expand by over 7% annually, thereby driving up the demand for industrial glucose. This trend suggests that companies within the Industrial Glucose Market may need to adapt their production strategies to cater to the evolving needs of the biofuel sector, potentially leading to new partnerships and collaborations.

Rising Demand for Natural Sweeteners

The Industrial Glucose Market is experiencing a notable increase in demand for natural sweeteners, driven by consumer preferences for healthier alternatives to artificial sweeteners. This shift is particularly evident in the food and beverage sector, where manufacturers are reformulating products to include natural ingredients. As a result, the market for industrial glucose, which serves as a key ingredient in various food products, is projected to grow significantly. According to recent estimates, the demand for industrial glucose in this sector is expected to rise by approximately 5% annually over the next five years. This trend indicates a broader movement towards clean label products, where transparency in ingredient sourcing is paramount. Consequently, companies within the Industrial Glucose Market are likely to invest in sourcing high-quality glucose derived from natural sources to meet evolving consumer expectations.

Technological Advancements in Production

Technological advancements in the production processes of industrial glucose are playing a crucial role in shaping the Industrial Glucose Market. Innovations such as enzymatic hydrolysis and fermentation techniques are enhancing the efficiency and yield of glucose production. These advancements not only reduce production costs but also improve the quality of the final product. For instance, the implementation of advanced bioprocessing technologies has been shown to increase glucose yields by up to 20%. Furthermore, these technologies enable manufacturers to produce glucose from a variety of feedstocks, including non-food sources, thereby diversifying supply chains. As a result, the Industrial Glucose Market is likely to witness a surge in production capabilities, allowing companies to meet the growing demand while maintaining competitive pricing.

Expanding Applications in Pharmaceuticals

The Industrial Glucose Market is witnessing an expansion in applications within the pharmaceutical sector. Glucose is increasingly utilized as an excipient in drug formulations, serving as a stabilizer and bulking agent. The rising prevalence of chronic diseases and the corresponding demand for effective medications are driving this trend. Recent data suggests that the pharmaceutical segment of the industrial glucose market is projected to grow at a compound annual growth rate of 6% over the next few years. This growth is attributed to the increasing need for glucose in intravenous solutions and oral rehydration therapies. As pharmaceutical companies continue to innovate and develop new formulations, the Industrial Glucose Market is likely to benefit from sustained demand for high-quality glucose products.

Regulatory Support for Sustainable Practices

Regulatory support for sustainable production practices is emerging as a key driver for the Industrial Glucose Market. Governments are implementing policies that encourage the use of renewable resources and environmentally friendly production methods. This regulatory landscape is prompting manufacturers to adopt sustainable practices in glucose production, such as utilizing waste materials and reducing energy consumption. As a result, companies that align with these regulations are likely to gain a competitive edge in the market. Recent studies indicate that adherence to sustainability standards can enhance brand reputation and consumer trust, which are increasingly important in today's market. Consequently, the Industrial Glucose Market is expected to see a shift towards more sustainable production methods, which may also lead to cost savings and improved operational efficiency.