Advancements in Laser Technology

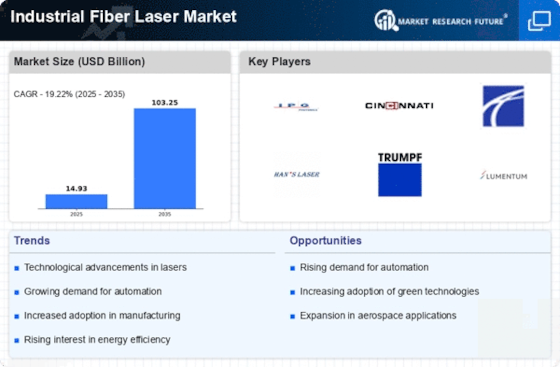

Technological advancements in laser technology are propelling the Industrial Fiber Laser Market forward. Innovations such as higher power outputs, improved beam quality, and enhanced cooling systems are making fiber lasers more efficient and versatile. These advancements enable applications across various sectors, including metal fabrication, medical device manufacturing, and electronics. Market analysis indicates that the fiber laser segment is expected to capture a significant share of the overall laser market, projected to reach 5 billion dollars by 2026. This trend suggests that ongoing research and development in laser technology will continue to drive growth in the Industrial Fiber Laser Market.

Expansion of the E-Commerce Sector

The rapid expansion of the e-commerce sector is significantly influencing the Industrial Fiber Laser Market. As online retail continues to grow, there is an increasing need for efficient packaging and labeling solutions. Fiber lasers are being utilized for high-speed marking and engraving on various materials, which is essential for product identification and branding. Market data suggests that the e-commerce industry is expected to reach a valuation of over 6 trillion dollars by 2024, creating a substantial opportunity for fiber laser applications in packaging. This trend indicates a strong potential for growth in the Industrial Fiber Laser Market as businesses seek to optimize their operations.

Increased Investment in Automation

The Industrial Fiber Laser Market is benefiting from increased investment in automation across manufacturing sectors. As companies strive to enhance operational efficiency and reduce labor costs, the integration of automated systems with fiber laser technology is becoming more common. This trend is reflected in market data, which shows that the automation market is anticipated to grow at a rate of 9% annually, reaching a valuation of 300 billion dollars by 2025. The synergy between automation and fiber lasers not only improves production speed but also enhances precision, thereby driving demand in the Industrial Fiber Laser Market.

Growth in Renewable Energy Applications

The Industrial Fiber Laser Market is witnessing growth driven by the increasing applications of fiber lasers in renewable energy sectors. Technologies such as solar panel manufacturing and steel wind tower production are increasingly utilizing fiber lasers for cutting and welding processes. The renewable energy market is projected to expand significantly, with investments expected to exceed 2 trillion dollars by 2030. This growth is likely to create a demand for advanced manufacturing technologies, including fiber lasers, which offer efficiency and precision. As industries pivot towards sustainable energy solutions, the Industrial Fiber Laser Market stands to benefit from this transition.

Rising Demand for Precision Manufacturing

The Industrial Fiber Laser Market is experiencing a notable surge in demand for precision manufacturing processes. Industries such as automotive, aerospace, and electronics are increasingly adopting fiber laser technology due to its ability to deliver high-quality cuts and engravings with minimal material waste. This trend is supported by data indicating that the precision manufacturing sector is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. As manufacturers seek to enhance productivity and reduce operational costs, the adoption of fiber lasers is likely to become more prevalent, thereby driving growth in the Industrial Fiber Laser Market.