Stringent Safety Regulations

The Industrial Electric Fuse Market is also shaped by the implementation of stringent safety regulations across various sectors. Governments and regulatory bodies are increasingly mandating compliance with safety standards to mitigate risks associated with electrical failures. This regulatory landscape compels industries to invest in high-quality electrical protection devices, including fuses, to ensure operational safety. For instance, the National Fire Protection Association has established guidelines that necessitate the use of reliable fuses in industrial settings. As a result, the demand for compliant products within the Industrial Electric Fuse Market is likely to grow, as companies prioritize safety and regulatory adherence.

Expansion of Renewable Energy Sources

The transition towards renewable energy sources is significantly influencing the Industrial Electric Fuse Market. As countries invest in solar, wind, and other renewable technologies, the demand for reliable electrical protection devices becomes paramount. Renewable energy systems often operate in variable conditions, necessitating robust fuses to safeguard against overloads and short circuits. The International Energy Agency indicates that renewable energy capacity is anticipated to increase by over 50% by 2025. This expansion not only enhances the need for industrial fuses but also presents opportunities for innovation within the Industrial Electric Fuse Market, as manufacturers develop specialized products tailored for renewable applications.

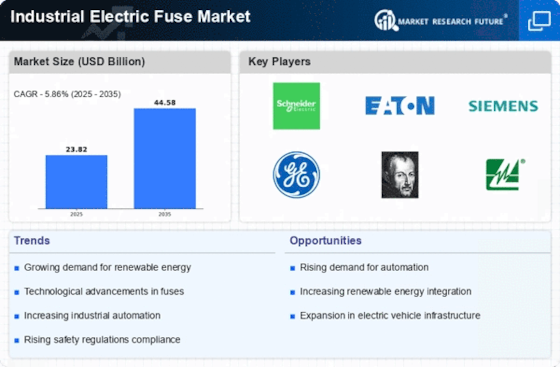

Rising Demand for Industrial Automation

The Industrial Electric Fuse Market is experiencing a notable surge in demand due to the increasing adoption of industrial automation across various sectors. As industries strive for enhanced efficiency and productivity, the reliance on automated systems has escalated. This trend is particularly evident in manufacturing, where automated machinery requires reliable protection against electrical faults. According to recent data, the automation market is projected to grow at a compound annual growth rate (CAGR) of approximately 9% over the next five years. Consequently, the need for robust electrical protection devices, such as fuses, is expected to rise, driving growth in the Industrial Electric Fuse Market.

Technological Innovations in Fuse Design

Technological advancements in fuse design are significantly impacting the Industrial Electric Fuse Market. Manufacturers are increasingly focusing on developing fuses that offer enhanced performance, reliability, and efficiency. Innovations such as smart fuses, which can provide real-time monitoring and diagnostics, are gaining traction. These advanced fuses not only improve safety but also contribute to the overall efficiency of electrical systems. The market for smart fuses is expected to grow at a CAGR of around 12% over the next five years. As industries seek to modernize their electrical systems, the demand for innovative fuse solutions within the Industrial Electric Fuse Market is likely to increase.

Growth in Electric Vehicle Infrastructure

The rise of electric vehicles (EVs) is creating new opportunities within the Industrial Electric Fuse Market. As the infrastructure for EV charging stations expands, the need for effective electrical protection becomes critical. Fuses play a vital role in safeguarding charging equipment from electrical faults, ensuring safe and reliable operation. The EV market is projected to witness substantial growth, with estimates suggesting that the number of charging stations could triple by 2030. This burgeoning infrastructure not only drives demand for industrial fuses but also encourages innovation in fuse technology to meet the specific requirements of EV applications within the Industrial Electric Fuse Market.