Rising Demand for Energy Efficiency

The Industrial Diesel Turbocharger Market is witnessing a growing demand for energy-efficient solutions across various sectors. Industries are increasingly focusing on reducing operational costs and minimizing environmental impact, which has led to a heightened interest in turbochargers that enhance engine efficiency. Data indicates that turbocharged engines can achieve up to 30% better fuel economy compared to naturally aspirated engines. This trend is particularly evident in sectors such as construction, agriculture, and transportation, where fuel costs constitute a significant portion of operational expenses. As companies strive to meet sustainability goals while maintaining productivity, the Industrial Diesel Turbocharger Market is poised for substantial growth, driven by the need for energy-efficient technologies.

Emergence of Renewable Energy Solutions

The Industrial Diesel Turbocharger Market is also being shaped by the emergence of renewable energy solutions. As industries transition towards more sustainable practices, there is a growing interest in hybrid systems that combine diesel engines with renewable energy sources. Turbochargers are essential in optimizing the performance of these hybrid systems, ensuring that they operate efficiently. The integration of turbocharging technology in renewable energy applications is expected to enhance overall system efficiency, making it a viable option for various industries. This trend indicates a potential shift in the Industrial Diesel Turbocharger Market, as manufacturers explore innovative solutions that align with the global push for sustainability and energy diversification.

Growth in Construction and Mining Sectors

The Industrial Diesel Turbocharger Market is benefiting from the robust growth in the construction and mining sectors. As infrastructure development accelerates, the demand for heavy machinery equipped with efficient diesel engines is on the rise. Turbochargers play a crucial role in enhancing the performance of these engines, enabling them to operate efficiently under heavy loads. Recent statistics suggest that the construction sector alone is expected to grow at a rate of 4.5% annually, further driving the need for advanced turbocharging solutions. This growth is likely to create new opportunities for manufacturers within the Industrial Diesel Turbocharger Market, as they cater to the increasing demand for high-performance machinery.

Technological Advancements in Turbocharging

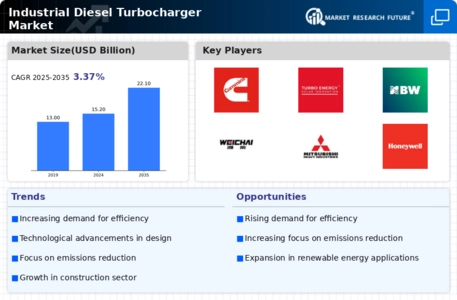

The Industrial Diesel Turbocharger Market is experiencing a surge in technological advancements that enhance performance and efficiency. Innovations such as variable geometry turbochargers and advanced materials are being integrated into designs, allowing for improved fuel efficiency and reduced emissions. According to recent data, the adoption of these technologies is projected to increase the market size significantly, with a compound annual growth rate of approximately 5.2% over the next five years. These advancements not only optimize engine performance but also align with regulatory standards, making them attractive to manufacturers and end-users alike. As industries seek to improve operational efficiency, the demand for advanced turbocharging solutions is likely to rise, further propelling the Industrial Diesel Turbocharger Market.

Regulatory Compliance and Emission Standards

The Industrial Diesel Turbocharger Market is significantly influenced by stringent regulatory compliance and emission standards imposed by governments worldwide. These regulations aim to reduce greenhouse gas emissions and improve air quality, compelling manufacturers to adopt cleaner technologies. The implementation of Euro 6 and Tier 4 emission standards has necessitated the integration of advanced turbocharging solutions to meet these requirements. As a result, the market is expected to expand as companies invest in technologies that not only comply with regulations but also enhance engine performance. The increasing pressure to adhere to these standards is likely to drive innovation within the Industrial Diesel Turbocharger Market, fostering the development of more efficient and environmentally friendly products.