Expansion of Manufacturing Sector

Germany's robust manufacturing sector plays a crucial role in the growth of the industrial diesel-turbocharger market. The country is renowned for its engineering excellence and high-quality production capabilities, particularly in automotive and machinery industries. In 2025, the manufacturing sector contributes approximately 22% to Germany's GDP, indicating a strong demand for industrial diesel engines equipped with turbochargers. This growth is likely to stimulate the need for advanced turbocharging solutions that enhance engine performance and efficiency. As manufacturers seek to comply with stringent emissions regulations, the industrial diesel-turbocharger market is poised to benefit from increased investments in turbocharger technologies that meet these evolving standards.

Rising Demand for Energy Efficiency

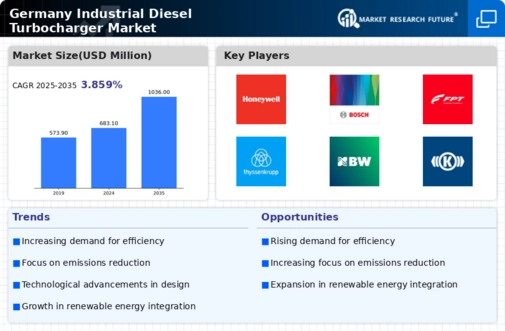

The industrial diesel-turbocharger market in Germany is experiencing a notable surge in demand for energy-efficient solutions. As industries strive to reduce operational costs and minimize environmental impact, the adoption of advanced turbocharging technologies becomes increasingly critical. The market is projected to grow at a CAGR of approximately 5.2% from 2025 to 2030, driven by the need for improved fuel efficiency and reduced emissions. Companies are investing in research and development to enhance turbocharger performance, which is expected to lead to innovations that further optimize energy consumption. This trend aligns with Germany's commitment to sustainability and energy transition, making energy efficiency a pivotal driver in the industrial diesel-turbocharger market.

Government Initiatives for Emission Reductions

The German government has implemented various initiatives aimed at reducing greenhouse gas emissions, which significantly impacts the industrial diesel-turbocharger market. Policies promoting cleaner technologies and stricter emissions regulations compel industries to adopt advanced turbocharging systems that enhance engine efficiency and lower emissions. The government aims to reduce CO2 emissions by 55% by 2030 compared to 1990 levels, creating a favorable environment for the adoption of innovative turbocharger solutions. This regulatory landscape encourages manufacturers to invest in the development of high-performance turbochargers, thereby driving growth in the industrial diesel-turbocharger market. The alignment of government policies with industry needs fosters a conducive atmosphere for technological advancements.

Increased Focus on Renewable Energy Integration

The integration of renewable energy sources into industrial processes is becoming increasingly prevalent in Germany, influencing the industrial diesel-turbocharger market. As industries seek to diversify their energy sources, the demand for hybrid systems that combine diesel engines with renewable technologies is likely to rise. This shift may lead to the development of turbochargers specifically designed for hybrid applications, enhancing overall system efficiency. The industrial diesel-turbocharger market could see a transformation as companies explore innovative solutions that leverage both diesel and renewable energy, potentially leading to a more sustainable industrial landscape. This trend reflects a broader commitment to energy transition and sustainability within the German industrial sector.

Technological Innovations in Turbocharger Design

Technological innovations in turbocharger design are significantly shaping the industrial diesel-turbocharger market in Germany. Advances in materials science and engineering have led to the development of lighter, more efficient turbochargers that can withstand higher temperatures and pressures. These innovations not only improve performance but also enhance the durability and reliability of turbocharging systems. In 2025, the market is expected to witness a rise in the adoption of variable geometry turbochargers (VGTs) and twin-scroll turbochargers, which offer superior performance across a range of operating conditions. As manufacturers continue to prioritize performance and efficiency, these technological advancements are likely to drive growth in the industrial diesel-turbocharger market.